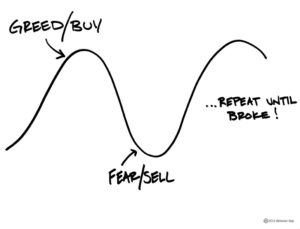

“Most of us make the same mistake with our money over and over again: We buy high out of greed and sell low out of fear, despite knowing on an intellectual level that it is a very bad idea.” – Carl Richards (Behavior Gap)

For those of a religious bent, greed is one of the seven deadly sins. Let’s leave that aside for now and take take a look at the dictionary definition of the word greed.

Greed: a selfish and excessive desire for more of something (as money) than is needed. (Merriam-Webster)

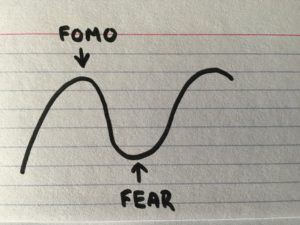

Regrettably I think the word greed in this context doesn’t ring true. I think today FOMO is a closer to fit to what is going on with investors today. A definition:

FOMO: fear of missing out: the fear of missing a social event or other positive experience, especially one that you have heard about through social media. (Macmillan)

FOMO: fear of missing out: the fear of missing a social event or other positive experience, especially one that you have heard about through social media. (Macmillan)

No one would mistake my artwork which combines Carl’s use of the Sharpie and Harold Pollack’s use of the index card.* I think we are missing out if we ascribe poor investor behavior to investor moral failings as opposed to a simpler reason: fear.

America today is anxiety-wracked. Below is an excerpt from an interview with Ruth Whippman author of America the Anxious: How Our Pursuit of Happiness is Creating a Nation of Nervous Wrecks.

Knowledge@Wharton: A state of perpetual anxiety does feel like a new norm right now for most Americans.

Ruth Whippman: Absolutely. The World Health Organization says that America is the most anxious country on the planet and by a wide margin. A second-place country is very far down the list from America. We are, in this country, more likely to suffer from clinical symptoms of anxiety than anywhere else on the planet.

Surprisingly this anxiety doesn’t seem to be driven by information overload. A more likely explanation is the challenge Americans are facing trying to stay on, if not climb, the income ladder. Recent figures show today’s 30 year olds are not keeping pace with their parent’s income at that same age. This generates anxiety for both child and parent alike.

This can manifest itself in career burnout or a chronic feeling of not having enough time for ourselves. The last thing some one who is facing these challenges wants to do is worry about their investments. That is where a good financial advisor can be worth their weight in gold. An advisor who can empathize with their client is providing a vital service. Michael Kitces at a Nerd’s Eye View writes:

In a world where the value of a financial advisor is increasingly about the uniquely-human relationship – and not just the expert financial knowledge that a computer can replicate – the skill of empathy becomes crucial.

The challenge for the advisor is that this relationship transfers, in part, this anxiety to the advisor. Carl Richards at Behavior Gap writes:

Your job, of course, is to absorb that with empathy, because you’re the release valve. It’s part of what you get paid for. To be honest, it’s part of the beauty of your role, because people don’t have anybody else to call. Thank heavens, they have you to call. It’s a part of your job. If you’re the release valve, another way to think of that is it’s also going to be part of your job, occasionally, to walk people in off the ledge.

If you’re the release valve for other people’s anxiety, and you’re walking people in off the ledge, and you’re not taking care of yourself, you’re not exercising your ability to deal with uncertainty. If you’re not taking care of yourself, it won’t be long before you’re the one out on the ledge.

Serving as an emotional guardrail for clients is a critical skill. The entire thrust of behavioral finance and economics shows us that we human beings are beset with a long list of biases and quirks. Many of these biases have built up over time in part because they helped human beings survive over time, but rational decision making they are not.

So where does FOMO fit in all of this? FOMO is in part a problem of connection. In today’s hyper-connected world we are never at a loss for some sort of distraction. We can constantly feel a sense of loss because of this newfound ability to see (and hear) what the rest of the world is experiencing. (This also includes the ability to feel negative emotions in light of profound horror.)

In the financial markets that means we will always feel a sense of disappointment. So not only is there always a ‘bull market somewhere‘ but now we are can also feel like we are always missing a bull market. With the build out of the ETF space we can now feel that pain all the more acutely because there is likely a corresponding instrument that would have allowed you to invest in that bull market.

Another consequence of feeling like you are missing out is that you are challenged to find your own way in the world. From Science Daily:

This ‘give me more’ and ‘I want that’ attitude can be detrimental to us both physically and mentally. In fact, recent studies have shown that FOMO is linked to feelings of dissatisfaction. “The problem with FOMO is the individuals it impacts are looking outward instead of inward,” McLaughlin [assistant professor at the Texas A&M Health Science Center College of Medicine and a psychiatry and behavioral health specialist with Texas A&M Physicians] said. “When you’re so tuned in to the ‘other,’ or the ‘better’ (in your mind), you lose your authentic sense of self. This constant fear of missing out means you are not participating as a real person in your own world.”

Nobody said this would be easy. Investors often make mistakes because they are not fully in touch with their own goals and risk tolerances. Every successful investor is successful in part because they have found a way to reconcile their investment style with their own unique (and flawed) personality. Looking elsewhere and not being your ‘authentic self’ will deprive you of the opportunity to find that balance.

Noticing when you are anxious about your portfolio or a portfolio position is the first step in breaking this cycle of chasing after hot stock ideas. Building a new habit around this trigger and finding a new routine and reward will lead to more thoughtful and conscious decisions. This is one reason why corporate America is beginning to embrace mindfulness and meditation for its workforce.

Robert Seawright at Above the Market recently published a long post that looks at the challenges, both investor and advisor alike, in building portfolios that explicitly take into account our own “flaws and imperfections.” First that assumes we can recognize those biases and that we can build around them in a harmonious manner. To quote Seawright (at length):

Investment portfolios that do not take our human foibles and shortcomings into account during their construction are broken even before they are implemented. By focusing a little more on human reality and a little less on technical perfection, we have an opportunity to improve our portfolios and even turn them into something more beautiful than the cold originals. If we are most meaningfully going to help our clients and if our clients are going to be able to stick with us and our portfolios, we must visibly incorporate our humanity into portfolio construction instead of disguising it or pretending it doesn’t exist. If we embrace the inevitability of our flaws and imperfections by creating kintsugi portfolios, portfolios that provide approaches, strategies, mechanisms and hacks to help us to withstand inevitable periods of turbulence and difficulty by trying to account for and patch up our metastasized poor judgment and behavior, we can give our clients a far better chance of real rather than just theoretical success – success that is substantive, obtainable and built to last.

The truly enlightened may be able to set aside the fear of missing out. For the rest of us it will always be an issue for investors. The only logical way I can see for investors to avoid FOMO is to ‘own everything.’ If you own everything then you, by definition, can’t miss out on anything. This ‘perfectly, imperfect portfolio’ serves the dual purpose of making sure you capture the non-normal distribution of returns inherent in the stock markets. As for regretting the things you do own and underperform that is a topic for another day.

*I can heartily recommend both of Carl’s books including The Behavior Gap: Simple Ways to Stop Doing Dumb Things With Your Money which includes the above graphic on the cover and Harold Pollack and Helaine Olen’s The Index Card: Why Personal Finance Doesn’t Have to Be Complicated.