Small changes in the beliefs of market participants can cause big market moves. Therefore trying to tease out why the stock market declines (or rises) over a short period of time is pretty fruitless. Chris Dillow at Stumbling and Mumbling writes:

We can avoid this mistake by recognising that the stock market is not like a person. Share prices are not an individual’s valuation of companies’ future prospects. They are instead the emergent, unintended outcome of countless individuals’ behaviour.

Therefore trying to craft some kind of coherent narrative about market moves is an exercise in frustration. But it is a perfectly normal reaction to situation. David Leonhardt at NYTimes writes:

Human beings need a story. It’s not enough to say an event has a 10 percent probability. People need a story that forces them to visualize the unlikely event — so they don’t round 10 to zero.

Economists have historically been reluctant to assign much (if any) importance to narratives. Robert Shiller writing at Chicago Booth Review argues that economists have much to learn from the humanities in crafting narratives about economics and finance. In that light I would highly recommend a (longer) piece by Morgan Housel at Collaborative Fund on the growing importance of storytelling for investors.

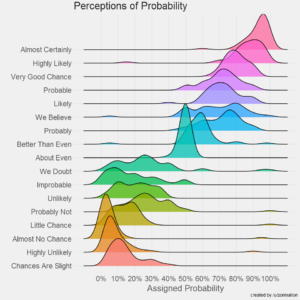

One of the big problems we face when discussing markets, economics or even politics is that each one of use has different perceptions about the use of probabilistic language. The graphic below summarizes some research on how we perceive certain words.

Source: github

In short, someone’s “very good chance” could be someone else’s “probably.” So our language matters. Sometimes the world changes and we don’t necessarily realize until later. That is why our word choice matters. Most of the time we simply don’t know what the heck is going on.

For everyone writing about markets a big market move is an opportunity. The majority of readers don’t pay attention to the stock market UNTIL something big happens. Then it matters a great deal. That is why we should think about whether our market-based narratives are not only sound but also speak in a way that the reader can take away clear, unambiguous points. Otherwise what are we doing?