Quote of the day

Joshua Brown, “When geopolitical tensions flare and the investor class sits up at attention, the character of the stock market tends to change almost immediately.” (The Reformed Broker)

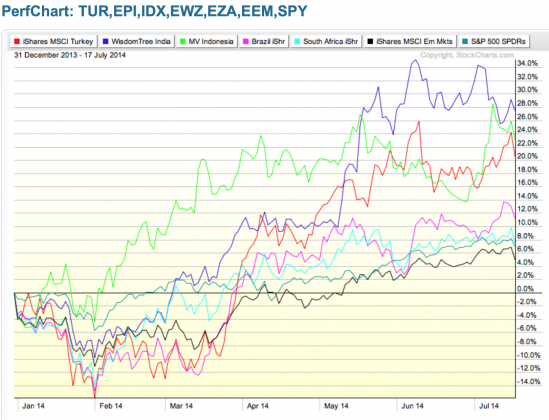

Chart of the day

The so-called Fragile Five are having a good 2014. (Dealbook)

Markets

How to approach a geopolitical induced sell-off. (Humble Student)

Fund managers can’t get enough equities. (Short Side of Long)

Which is worse: a rise in Treasury yields or credit spreads? (Aleph Blog also Income Investing)

Every streak must end: a 1% market move happened. (Ryan Detrick)

Are biotech stocks really in a bubble, Janet Yellen? (MoneyBeat)

Strategy

Hedge funds love spin-off situations. (Stock Spinoffs)

Saying you are “bullish or bearish” is pretty much meaningless. (A Wealth of Common Sense)

Five ways to improve your trading today. (Adam Grimes)

Seven ways to blow up your trading account. (The Flying Investor)

Cullen Roche author of Pragmatic Capitalism: What Every Investor Needs to Know About Money and Finance talks with Michael Covel. (Trendfollowing Podcast)

Companies

One big reason for a 21st Century Fox ($FOXA) with Time Warner ($TWX) deal: sports. (Dealbook)

Finance

Why hedge fund activists are on the rise. (Institutional Investor)

Funds

What Vanguard earns for its funds via securities lending. (Bogleheads)

The ETF Deathwatch for July 2014. (Invest with an Edge)

Economy

Q2 GDP is looking up. (Bonddad Blog)

American companies are pushing more cash to shareholders relative to investments. (FiveThirtyEight)

Earlier on Abnormal Returns

What you might have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

Does @SavedYouAClick prove Betteridge’s Law? (Peter Hilton via Betteridge’s Law)

Amazon ($AMZN) is now offering an all-you-can-read option with Kindle Unlimited. (GigaOM, Recode)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.