Quote of the day

David Merkel, “Like any other thing in investing, no one is out to do you a favor. New stock tends to be offered at a time when valuations are high, and companies tend to be taken private when valuations are low.” (Aleph Blog)

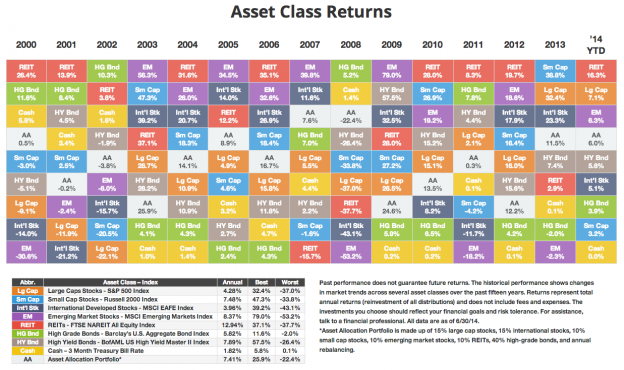

Chart of the day

Asset class returns: nobody knows nothing. (Barry Ritholtz, Novel Investor)

Quant

Just because the $VIX is low (or high) does not mean it is a buy (or sell). (Volatility Made Simple)

On the advantages of mechanical trading strategies. (Quantified Strategies via @Whole StreetRT)

What does the first half hour trading tell us about end of day trading. (Alpha Architect)

Strategy

Why it would be a mistake to trade like George Soros. (Brian Lund)

Warren Buffett is hoarding cash. Why aren’t you? (James Saft)

Investing is more about psychology than strategy. (Millenial Invest)

The dark side of technical analysis. (Adam Grimes)

Companies

Why pharmaceutical companies don’t invest to find new antibiotics any more. (James Surowiecki)

Was the downfall of Radio Shack ($RSH) inevitable? (NYTimes)

Why mobile advertisers love Facebook ($FB). (Daniel Nadler)

Finance

Bank of America ($BAC) is paying a record fine to put mortgage issues behind them. (Bloomberg)

Goldman Sachs ($GS) junior bankers just got a big pay raise. (FT, Quartz)

Big deals don’t always mean big fees these days. (Dealbook)

Funds

Investors are pouring money into the Vanguard Group. (WSJ)

Why institutional investors are “satisfied” with hedge fund performance. (FT Alphaville)

The threshold for ‘accredited investor‘ is likely to increase. (CNBC)

Global

The world is getting old…fast. (CNN)

Economy

The chicken or egg problem facing the US economy. (Conor Sen)

Weekly initial unemployment claims continue to trend at expansionary levels. (Calculated Risk)

The Philly Fed has hit a multi-year high. (Bespoke)

Corn and soybean yields are off the charts. (WSJ)

A review of Daniel Drezner’s The System Worked: How the World Stopped Another Great Depression. (FT Alphaville)

Earlier on Abnormal Returns

What you might have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Six things you need to know to be great in business. (Blog Maverick)

Nobody is paying attention to your conference call. (The Atlantic)

On the price of great customer service. (NYTimes)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Tumblr and Twitter.