Earlier this week we wrote about the state of the app economy and the idea of how bundling and unbundling help define how software has progressed over time. Not only on the smartphone but on the PC before. Some additional data help demonstrate how the app economy has become somewhat satiated, or some might say stagnant over time.

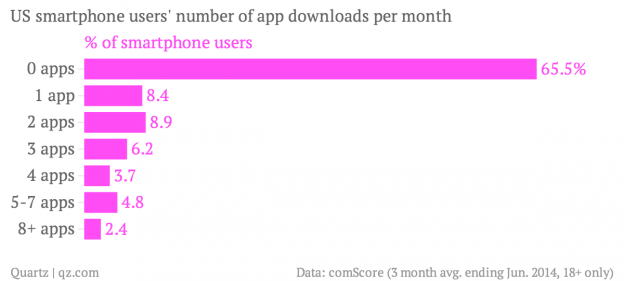

Dan Frommer at Quartz citing a comScore report notes that nearly two-thirds of smartphone users don’t download any new applications in a month.

There are a number of explanations for this but it may simply be the case that most users have their needs met by the most used apps. Frommer writes:

One possible explanation is that people just don’t need that many apps, and the apps people already have are more than suitable for most functions. Almost all smartphone owners use apps, and a “staggering 42% of all app time spent on smartphones occurs on the individual’s single most used app,” comScore reports. New apps come and go, especially games, but perhaps breakthrough apps will be increasingly rare. A look at the top 25 most-used apps reflects mostly mature companies, including Facebook, Google, Pandora, and Yahoo.

Facebook ($FB) has taken the approach to be a “mobile conglomerate” buying insurgent apps that might threaten their core services. Rather than integrating them Facebook has kept Instagram and WhatsApp separate for now. Google ($GOOG) has six different apps that show up on the list of the top 25 most-used apps. Yahoo ($YHOO) has three.

What we are seeing is “stealth bundling.” Companies buying services for strategic and competitive reasons but choosing not to explicitly bundle them together like happens in other markets. A company like Uber is taking a different tack opening up its API to third parties in order to increase its reach. Whether it is explicit or by stealth companies might take they are trying to increase their share of your mobile spending. So for now, bundling is on the rise.