Quote of the day

Ben Steverman, “Choosing a hedge fund requires expertise and a healthy appetite for investing jargon. Alternative funds are being marketed to people who have neither.” (Bloomberg)

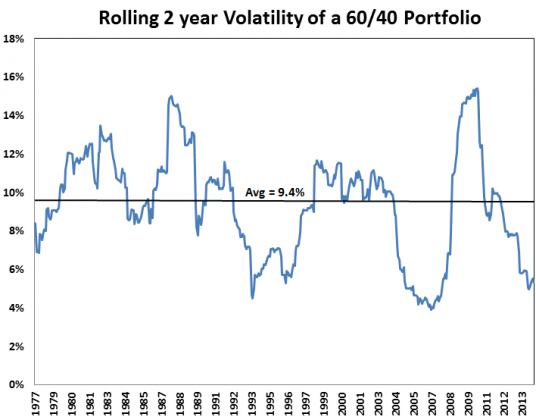

Chart of the day

Why everyone is feeling good: low volatility. (A Wealth of Common Sense)

Markets

On the outperformance of defensive sectors YTD. (Charlie Bilello)

Jim Rogers is now hot on Russian stocks. (FT Alphaville)

The bear case for commodities is based in part on a disbelief in China. (Market Anthropology)

Strategy

A primer on the Appraisal Ratio. (Alpha Architect)

The case for the profitability factor. (Monevator)

Books

Tony Robbin’s Money – Master the Game: 7 Simple Steps to Financial Freedom “comes up short.” (Pragmatic Capitalism)

Suzanne McGee on the new Tony Robbins book, “But being good at counseling and pep talks doesn’t qualify Robbins to provide financial advice…It’s a common American superstition that those who have earned wealth are qualified to provide advice to others on managing it.” (The Guardian)

A short list of the best books for investors including Alice Schroeder’s The Snowball: Warren Buffett and the Business of Life. (Jason Zweig)

Companies

Amazon ($AMZN) is getting into the handyman game. (Recode)

Venture capitalists are pouring money into robotics. (Real Time Economics)

The tech industry should brace for additional regulation. (WSJ)

Funds

In defense of the performance of the Hussman Strategic Growth fund. (Economic Musings)

What are we to make of merger arbitrage funds? (Morningstar)

Economy

The past six months has been a strong stretch for the US economy. (Real Time Economics, Bespoke)

The pace of home price appreciation is slowing. (Calculated Risk)

Earlier on Abnormal Returns

What you might have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

432 Park Avenue is a monument to income inequality. (Josh Brown)

The Internet has made consumers less impulsive and “more intentional.” (WSJ)

Mixed social media incentives don’t necessarily lead to information efficiency. (SSRN via @tylercowen)

Stuff

Stuff every video fan should own including the new Amazon Fire TV. (Quartz)

The Google ($GOOG) Chromecast keeps adding services. (GigaOM)

Want to turn your iPad Air 2 into an Macbook Air? A review of the BrydgeAir keyboard. (AppleInsider)

You can support Abnormal Returns by visiting Amazon, signing up for our daily newsletter or following us on StockTwits, Yahoo Finance and Twitter.