Quote of the day

John Kay, “The days when economic power was acquired by inheriting the mill are long gone. Mr Buffett began his business career as a mill owner, but closed the mills and went into insurance. That is the reality of capital in modern economics.” (FT)

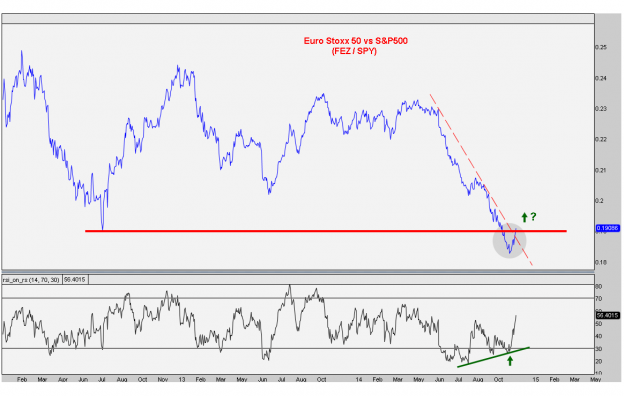

Chart of the day

Signs of life in European stocks. (All Star Charts)

Markets

When new market highs are boring. (The Reformed Broker)

By this measure investors are as bullish as they have been in over a decade. (Dana Lyons)

The energy sector has been declining for some time now. (Pension Partners)

Good luck trying to time relative domestic/international stock performance. (Total Return)

Strategy

Seven simple things investors don’t do. (A Wealth of Common Sense)

How limits (or constraints) can actually make you a better trader. (TraderFeed)

You only get so many trades: use them wisely. (Gatis Roze)

Transportation

BMW is trying to change the way the sell cars with Apple-inspired ‘geniuses.’ (Fortune)

There is a better way to board an airliner. (The Atlantic)

Uber

Another way in which Uber is unique: no acquisitions to-date. (Pando Daily)

Why Uber is getting so much attention. (Fast Company)

What could go wrong at Uber? (Rick Bookstaber)

Finance

The muni meltdown that wasn’t. An in-depth look at the problems caused by ‘muni tourists.’ (Bloomberg)

What do sell-side analysts really do these days? (Matt Levine)

Funds

Lessons from the autopsy of a closed ETF. (ETF)

The proper way to show mutual fund expenses. (Rekenthaler Report)

The downside of mutual funds: tax inefficiency. (ETF)

How does anyone sort through the competing claims about smart beta strategies? (FT)

A podcast discussion with Wes Gray of the ValueShares US Quantitative Value ETF ($QVAL). (The ETF Store)

Energy

Cheap energy is the new cheap labor. (FT)

Oil prices won’t stay low forever. (Alliance Bernstein)

Economy

Weekly initial unemployment claims jumped last week. (Calculated Risk, Bespoke)

Private wage growth is looking healthy. (Capital Spectator)

The federal government has stopped being a drag on the economy. (FT Alphaville)

The weather really can hold back the economy. (Real Time Economics)

Earlier on Abnormal Returns

Podcast Friday Wednesday: why podcasting is likely to get more ambitious. (Abnormal Returns)

What you might have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

The Amazon Fire HDX 8.9 is pretty good. (Wired)

Roku vs. Chromecast vs. Fire: which streaming stick is best? (GigaOM)

The best smartphones out there including the overall winner the iPhone 6. (WSJ)

You can support Abnormal Returns by visiting Amazon, signing up for our daily newsletter or following us on StockTwits, Yahoo Finance and Twitter.