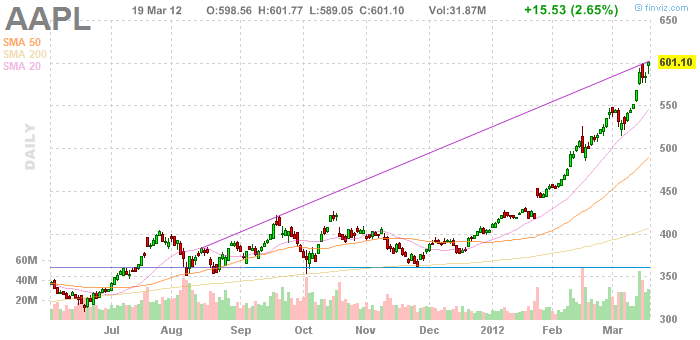

In case you missed it earlier today Apple ($AAPL) announced a regular dividend, stock buyback and also announced 3 million “new” iPads sold over the weekend. In short a big day by all accounts. And the stock did what it seems to always do – go up. We have accumulated a number of links that come at Apple from all angles. We didn’t want to overwhelm tomorrow’s linkfest with them so here they hot off the Interweb.

The move in Apple is one of “the most incredible stories in stock market history.” (Pragmatic Capitalism)

How Apple compares to other “mega success stories.” (MarketBeat)

Apple’s dividend is “sensible.” (Felix Salmon)

A list of some other companies loaded with cash and don’t yet pay a dividend. (MarketBeat)

The dividend decision has all the characteristics of CEO Tim Cook. (GigaOM)

Why Apple holders should take pause. (TheArmoTrader)

Don’t forget Apple used to pay a dividend, back in the dark ages for the company. (Ivanhoff Capital)

Apple will now attract a slew of out-of-the-money put sellers. (Barron’s)

Why Apple should buy Twitter. (Big Picture)

What Apple’s huge overseas cash hoard tells us about the futility of the current corporate tax system. (Justin Fox)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.