Last year I got all excited when Credit Suisse released its annual global investment returns yearbook. In part, because I used some of the data in an earlier version of that publication to help me write my own book. Well it is that time of year again and the new Credit Suisse Global Investment Returns Yearbook 2013 is now out. Dimson, Marsh and Staunton the authors of the yearbook are also the authors of the much cited Triumph of the Optimists: 101 Years of Global Investment Returns.

In addition to their annual look at returns across a number of countries and time frames the authors take an in-depth look at three topics:

- The stresses and challenges of a low-return world;

- The evidence for mean-reversion in equity returns and

- Is inflation good for equities.

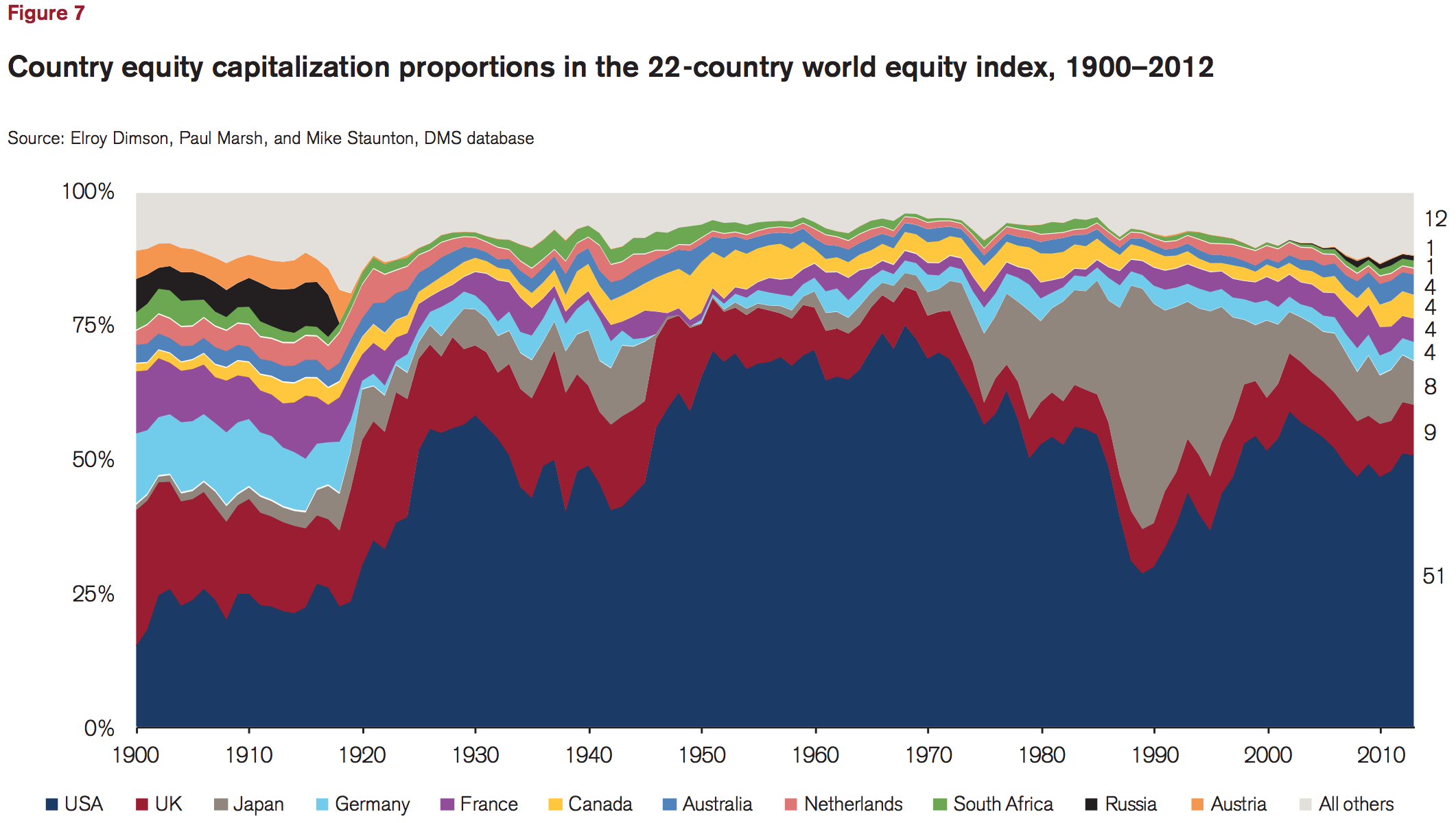

There is a number of great charts in the document but I thought this chart presents a great deal of information on the global equity market all in one big graph.

As I wrote last year:

In short, this document is a must-read. Sell-side research comes in for a lot of criticism of late from all corners of the blogosphere. However a document like this shows that there still is some great research being produced. And the price is right. You can thank me later for the recommendation….

Some other posts that mention the yearbook:

Low yields, mean reversion focus of 2013 Credit Suisse Global Investment Yearbook 2013. (Investment Europe)

Investors can expect low returns for 20 to 30 years. (Pensions & Investments)

My #1 read of the year. (The Idea Farm)

Why market timing doesn’t work. (The Source)