Quote of the day

Felix Salmon, “Money should be invested; the government has no business encouraging corporations and institutional investors to simply park it in a bank instead.” (Reuters)

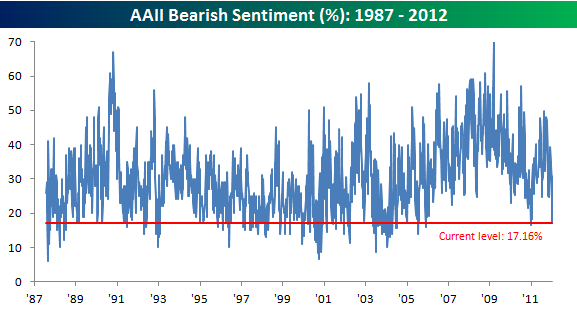

Chart of the day

Where did all the bears go? (Bespoke)

Markets

The year in tickers. (Howard Lindzon)

The ‘BRIC decade’ was golden for investors. (research puzzle pix)

The US dollar is hitting new 52-week highs. (StockCharts Blog)

The myth of the January effect. (CXO Advisory Group)

A list of GARP-y stocks. (MarketBeat)

Strategy

The latest Jeffrey Gundlach presentation everyone is talking about. (Money Game)

Don’t look now but the financial stocks are putting in a bottom. (Dragonfly Capital)

Transportation stocks continue to act well. (chessNwine)

In praise of the “permanent portfolio.” (Aleph Blog)

Would your holdings survive the “overnight test“? (Bucks Blog)

Companies

Corporate America has $2 trillion of cash to play with it 2012. (FT)

Would Apple ($AAPL) stores in Target ($TGT) broaden its footprint or cheapen the brand? (GigaOM)

Tell me why doesn’t Apple buy Netflix ($NFLX)? (I Heart Wall Street)

What killed Eastman Kodak? (The Atlantic)

Oil refineries keep on getting shuttered. (FT)

Finance

How uninsured deposits cause instability in the financial system. (FT Alphaville)

Wilbur Ross has a taste for damaged financial institutions. (Businessweek)

On the changing (and less lucrative) state of the private equity industry. (WSJ)

Now it seems that CME Group ($CME) failed its responsibility to oversee MF Global. (Dealbook, Points and Figures)

Do we need to fix the IPO process? (The Reformed Broker)

Funds

How worried should we be about self-indexing? (IndexUniverse)

Checking in on the 2011 performance of 40 top hedge funds. (Insider Monkey)

Malta is the new Stamford. (Dealbreaker)

Global

Why is the UK so anti-capital when capital is its main industry? (Economist)

Checking in on the situation in Hungary. (FT Alphaville, WSJ)

India’s stock market has become twitchy. (beyondbrics)

Economy

The December jobs report came in ahead of expectations. (Calculated Risk, ibid, MarketBeat, Mark Thoma, Daniel Gross, Free exchange, EconomPic Data)

The Conference Board’s index of leading economic indicators is getting an overhaul. (Real Time Economics)

Checking in on consumer spending. (Tim Duy)

Still no recession in rail traffic. (Pragmatic Capitalism)

Earlier on Abnormal Returns

DIY investing and the IKEA effect. (Abnormal Returns)

What you missed in our Friday morning linkfest. (Abnormal Returns)

Education

Teacher quality matters…a lot. (NYTimes)

Why do we think that shepherding kids into STEM college majors will work out? (Bloomberg)

Don’t let the economy pick a major for you. (The Atlantic)

Mixed media

Call your Mom! (WonkBlog)

Abnormal Returns is a founding member of the StockTwits Blog Network.