Quote of the day

Josh’s Old Boss, “Had I known Josh’s blog was going to get so big, I never would’ve allowed him to do it.” (The Reformed Broker)

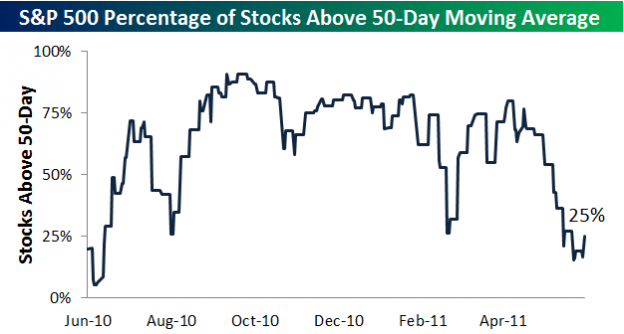

Chart of the day

25% of S&P 500 stocks are trading above their 50-day moving averages. (Bespoke)

Strategy

Silver, oil and the Euro. (Market Anthropology)

What happens if Treasuries are no longer viewed as risk-free? (EconLog)

How much should we fear the exodus from high yield? (FT Alphaville)

How much effort should you put into building a better index fund? (Capital Spectator)

Oil

Fading the IEA. (Trader’s Narrative)

Cheaper gas is on the way. (Daniel Gross, Calafia Beach Pundit, Pragmatic Capitalism)

The Brent-WTI spread narrow modestly. (Bespoke)

Companies

Why do airlines lose so much money? (Freakonomics)

Can a tech bubble inflate if so many people are talking about a bubble? (FT Alphaville)

What is Charlie Ergen doing with all these disparate communications assets? (Dealbook)

Finance

The Carlyle Group is coming public market volatility be damned. (FT)

Don’t sweat the small stuff like intraday index pricing. (Kid Dynamite)

Why go public as a US-based company when tax-havens beckon? (WSJ)

John Paulson lost less on Sino-Forest than previously thought. (Dealbreaker)

Ralph Nader as activist investor. (WSJ, The Tech Trade)

Global

What good are sovereign credit default swaps if credit events can be manipulated? (FT)

When will Greece from ‘messy’ to ‘ugly and fractious’? (Felix Salmon)

China is shifting from paper assets to hard assets. (The Source)

Russia as a hot market for fast food franchises. (beyondbrics)

Economy

Ben Bernanke wants fiscal authorities to do some heavy lifting. (Credit Writedowns)

The Fed keeps cutting their estimates for economic growth. (Free exchange)

Has the US economy fallen below its stall-speed? (FT Alphaville)

The ECRI WLI keeps on easing. (MarketBeat)

Rail traffic growth keeps slowing. (Pragmatic Capitalism)

Earlier on Abnormal Returns

Traders, turn off CNBC! (AR Screencast)

ARTV on the desert island blogger quiz. (Abnormal Returns)

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

Hindsight bias and why its so hard to call a bubble. (Slate)

Abnormal Returns is a founding member of the StockTwits Blog Network.