Chart of the day

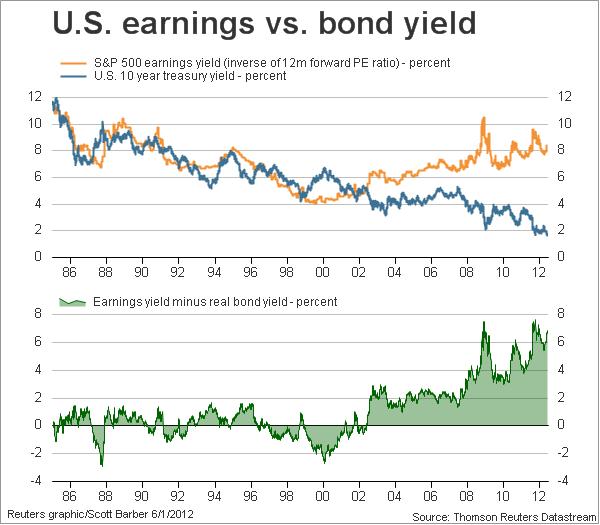

US earnings yields vs. bond yields: the long view. (Reuters)

Month in review

A look at dismal May major asset class performance. (Capital Spectator)

Low volatility strategies outperformed in May. (Falkenblog)

There was a 10% spread between financials and utilities for May. (StockCharts Blog)

Markets

Ten year government bond yields around the globe. (Big Picture)

Putting this pullback into perspective. (VIX and More)

All or nothing days are back. (Bespoke)

Where one TAA model stands. (MarketSci Blog)

Strategy

How to trade when market mechanics are broken. (Brian Lund)

Put selling as a replacement for stocks. (EconomPic Data)

Should we scrap the 401(k)? (Reuters also IndexUniverse)

Companies

Apple ($AAPL) could have $200 billion in cash by the end of next year. (Apple 2.0)

How to value the morass that is Loews ($L). (The Brooklyn Investor)

Not for long…print still remains a big revenue generator. (GigaOM)

Finance

Pension funds are dealing with the problem of ‘zombie funds‘ or private equity funds that just won’t die. (WSJ)

Investment managers will always need the ability to communicate. (the research puzzle)

The secret sauce to institutional investment revealed. (Institutional Investor)

Why the Facebook IPO was a success. (Vitaliy Katsenelson)

Funds

Hedge funds are cutting back on sell-side research. (FT)

Mutual funds don’t want hedge funds to be able to advertise freely. (WSJ)

Investment management fees are much higher than you realize. (Total Return)

Economy

It’s hard to find a silver lining in the May NFP report. (Calculated Risk, ibid, Daniel Gross, Economix, Free exchange, The Atlantic)

The ISM manufacturing index for May shows continued expansion. (Calculated Risk, Bespoke)

Rail traffic continues to grow. (Pragmatic Capitalism)

Hoarding gold as anti-social behavior. (FT Alphaville)

Earlier on Abnormal Returns

What you missed in our Friday morning linkfest. (Abnormal Returns)

Books

Another interesting interview with Jack Schwager author of Hedge Fund Wizards. (All About Alpha)

Richard Florida talks about the American economy with Daniel Gross author of Better, Stronger, Faster: The Myth of American Decline. (The Atlantic)

Mixed media

Ten things economics can tell us about happiness. (The Atlantic)

Ten things to do this Summer. (HedgeWorld)

Abnormal Returns is a founding member of the StockTwits Blog Network.