Quote of the day

John Coumarianos, “The longer the markets disobey basic rules of valuation, the bigger the opportunity for good investors to reap the benefits. Value investing works precisely because markets become dysfunctional at times.” (Institutional Imperative)

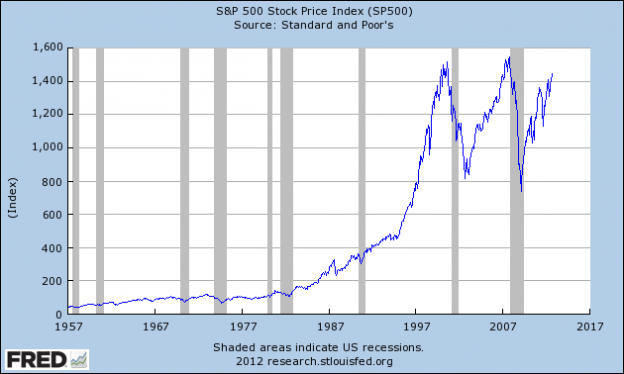

Chart of the day

Can we be in a recession if the stock market is still trading at the highs? (Bonddad Blog)

Markets

Is biotech a reliable leading indicator of the broader market? (MarketSci Blog)

An astonishing fact about the stock market since 2010. (TheArmoTrader)

Why do bubbles form? (Pragmatic Capitalism)

In what ways trading is a ‘pure’ activity. (StockCharts Blog)

Value investing

Warren Buffett won over the long run by leveraging his holdings of low volatility stocks. (Economist)

Another positive review of Ronald Chan’s The Value Investors: Lessons from the World’s Top Fund Managers. (Aleph Blog)

Is John Bogle’s The Clash of the Cultures: Investment vs. Speculation his best book? (IndexUniverse)

Technology

Tim Cook is sorry about the whole iOS 6 Maps fiasco. (Apple also Pogue)

Twitter, Instagram and Facebook ($FB): which is bigger? (Phil Pearlman)

Might Dwolla and Square team up to take on the credit card companies? (Quartz)

Companies

The Great Recession, among other things, helped kill the big box retailers. (research puzzle pix)

An open letter to the board of Crown Media Holdings ($CRWN). (SumZero)

Finance

The impact of quants on the markets is only set to accelerate. (FT Alphaville)

Money market mutual fund reform is back on the table. (Bloomberg)

Don’t jump into crowdfunding just because it is the cool new thing. (The Fiscal Times)

ETFs

WisdomTree Investments ($WETF) stock price discounts rapid growth in AUM. (The Brookly Investor)

Are frontier market ETFs worth the now lower price? (Ari Weinberg)

A look at the strategy behind the RBS US Large Cap Alternator ETN ($ALTL). (Invest With an Edge)

QE3

Everyone worried about QE-induced inflation is missing the point. (FT Alphaville)

How Ben Bernanke convinced the FOMC to go forward with QE3. (WSJ)

The Fed is the only thing holding us back from a recession. (Big Picture)

The international relations of QE3. (Daniel Drezner)

Economy

Consumer spending is hanging in there, for now. (Capital Spectator, Calculated Risk)

The Chicago PMI disappoints, badly. (TRB, Money Game)

How come property taxes never dropped. (Eye on Housing)

Earlier on Abnormal Returns

In case you missed it our earlier our Amazon Money & Markets list of twelve investing books that go above and beyond. (Abnormal Returns)

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

It’s official: news is all about social and mobile. (GigaOM)

Complex organizations are not particularly resilient. (HBR)

The ten best political movies of all time. (Paste Magazine)

Abnormal Returns is a founding member of the StockTwits Blog Network.