Quote of the day

Brett Steenbarger, “Some traders are attracted to markets as a way to exercise their strengths and some are attracted to markets to compensate for their weaknesses.” (TraderFeed)

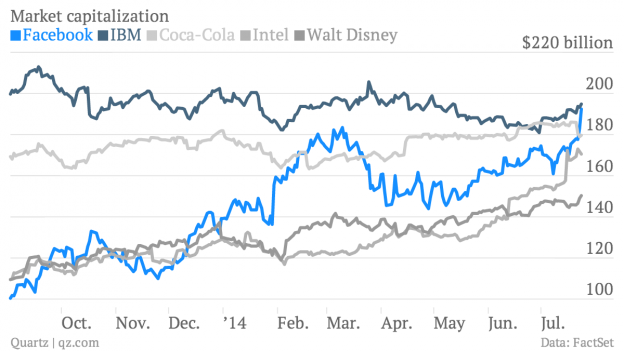

Chart of the day

Facebook ($FB) is now bigger than Coca-Cola ($KO) and Disney ($DIS). (Quartz)

Markets

How much do earnings need to grow to make stocks cheap? (Scott Krisiloff)

Small cap relative performance can run for years. (A Wealth of Common Sense)

Why the outcome of any single trade doesn’t matter. (Adam Grimes)

Mark Cuban won’t own stock in companies doing tax inversions. (MoneyBeat, Business Insider)

The most important charts in the world. (Business Insider)

Companies

Burger King ($BKW) is run by a cadre of young execs. (Businessweek)

What’s Apple ($AAPL) worth? (Asymco)

Just how big is the effective size of the mobile market? (a16z)

Nobody wants to compete with Google ($GOOG) in search. (Quartz)

Instead of spending money on buybacks maybe the big airlines can get wi-fi to work on all its planes? (WSJ)

Finance

A nice primer on the new money market fund rules. (Rekenthaler Report)

The middle class can’t afford life insurance. (WSJ)

Funds

Closed-end funds are cutting their distributions. (Focus on Funds)

Retail investors are fleeing high yield bond funds. (WSJ, FT)

Global

The UK economic recovery in 13 charts. (FT Alphaville)

How can emerging market growth be so weak while credit spreads so tight? (FT Alphaville)

Economy

Chemical activity shows continued growth. (Calculated Risk)

The number of US factories have stopped going down. (Real Time Economics)

Housing is a risk factor for the US economy. (Capital Spectator)

Corn farmers are facing a down year. (WSJ)

Earlier on Abnormal Returns

Six Essential Principles from Pragmatic Capitalism by Cullen Roche. (Abnormal Returns)

What you might have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

Yahoo Finance and Seeking Alpha are parting ways. (Street Insider)

Yahoo Finance launches its Yahoo Finance Contributors network. (TheStreet)

RIP, Ace Greenberg. (Business Insider)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.