Quote of the day

Carl Futia, “So as a practical matter you should count yourself fortunate indeed if you consistently capture a small part of any given market swing.” (Carl Futia)

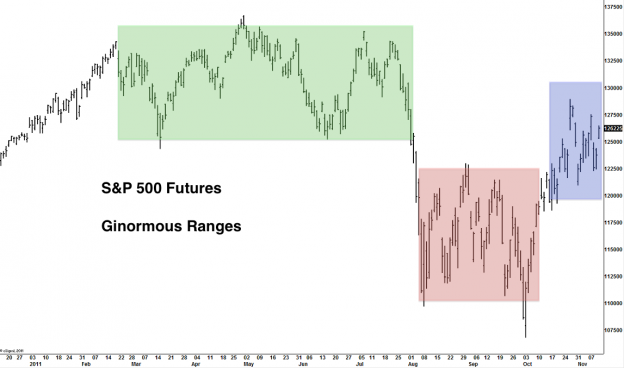

Chart of the day

The S&P 500 has spent 2011 trading in “ginormous ranges.” (Dynamic Hedge)

Markets

The market is “grinding higher.” (Big Picture)

Momentum stocks have taken a hit, while big Nasdaq names stand ready to breakout. (Fund My Mutual Fund, All Star Charts)

3Q earnings could have been better. (Big Picture)

Gold is “resting.” (TheArmoTrader also Afraid to Trade)

Oil is solidly above its 200 day moving average and the WTI-Brent spread is coming in. (Bespoke, ibid)

Strategy

You can’t trade if you aren’t healthy. (Phil Pearlman)

Sometimes the best trade is no trade. (SurlyTrader)

Now is the time to start looking for tax loss harvesting candidates. (iShares Blog)

Don’t believe everything you read about bubbles. (Total Return)

Research

Can risk management techniques save momentum? (Turnkey Analyst

Perfect timing for the launch of the Cleveland Financial Stress Index. (SSRN, Cleveland Fed)

Technology

Reconciling long lines and Apple ($AAPL) iPhone 4S production shortfalls. (SAI)

Flash is dead. Long live HTML5. (WSJ)

What Zynga is doing with stock options is pretty much business as usual. (Term Sheet)

Companies

Disney ($DIS) is doing just fine outside of Europe. (Crackerjack Finance)

How Sony ($SNE) barely makes money. (SplatF)

Starbucks ($SBUX) for the win in the juice business. (Herb Greenberg, ValuePlays)

Hard to see how defense spending doesn’t decline. (Money & Co.)

Finance

What is the optimal level of a Tobin tax? (Wilmott contra WSJ)

The Fed’s primary dealers are falling like flies. (WSJ)

2011 has not been a good year for the retail forex firms. (Focus on Funds)

Are we asking too much of pension funds? (Felix Salmon)

Global

Checking in on European bond yields. (Calculated Risk, MarketBeat)

Even Germany, at this price, is not a safe haven bond market. (Pragmatic Capitalism)

What are the real prospects for a downgrade of France? (FT)

The mechanics of leaving the Euro are not easy. (Planet Money)

Italian stocks are cheap, but likely to get cheaper. (Marketwatch)

Joe Weisenthal, “The fact of the matter is that we’re not on a gold standard. Period.” (NetNet)

India is getting hit with the European slowdown. (Credit Writedowns)

Economy

Consumer sentiment bounces. (Calculated Risk,

What exactly is in the ECRI indicators? (Stone Street also MarketBeat)

Rail traffic continues to show gains. (Pragmatic Capitalism)

The bi-partisan case for old fashioned infrastructure spending. (USA Today via Felix Salmon)

Remember the “Super Committee“? (WSJ)

Earlier on Abnormal Returns

Business risk and the risk of underperformance. (Abnormal Returns)

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

Happy birthday iBankCoin. (The Fly)

Certain inequalities are better than others. (NYTimes)

Jeff Matthews on Steve Jobs![]() : “Read this book.” (Jeff Matthews)

: “Read this book.” (Jeff Matthews)

Abnormal Returns is a founding member of the StockTwits Blog Network.