Quote of the day

Phil Pearlman, “If you don’t have a good plan, then what the hell are you doing? The market is inhabited by sharks who eat people with no plans or who abandon their plans under anxiety.” (Phil Pearlman)

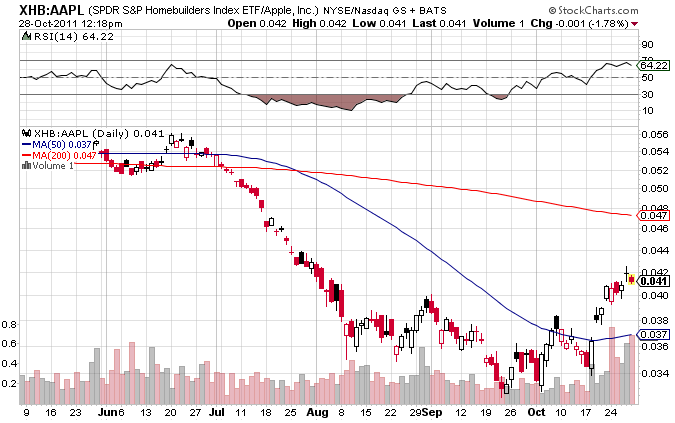

Chart of the day

A sign of the times: homebuilders are outperforming Apple ($AAPL). (Money Game)

Markets

The wall of worry has crumbled. (Mark Hulbert)

The rally is being led by the prior losers. (Bespoke)

Talk about an all or nothing market. (Bespoke)

Something has changed in the crude oil market. (FT Alphaville)

Muni bonds now yield more than Treasuries. (Muniland)

Strategy

Time for the stock replacement strategy. (Investing With Options)

What is a sustainable amount to risk per trade? (Peter L. Brandt)

You are not your trades. (Crosshairs Trader)

Strategy vs. implementation: what matters more? (Interloper)

Companies

The long story of a Netflix ($NFLX) short. (Margin of Safety)

Will somebody please write an ending to the Yahoo! ($YHOO) story? (WSJ)

Why succeed, when failure pays so well? (The Reformed Broker)

Google ($GOOG) is no longer the money machine it was in prior years. (Musings on Markets)

Is Groupon worth $10 billion? (Megan McArdle)

How big is the “smart TV” opportunity? (Asymco)

Finance

How short-sellers keep us all honest. (Dealbreaker)

The Greek CDS situation is absurd. (Finance Addict, Credit Writedowns also Felix Salmon)

The MF Global ($MF) endgame is afoot. (The Source, MarketBeat)

The Volcker Rule is simply way too complicated to work effectively. (FT)

All the benefits of going public without having to actually give up control. (WSJ)

ETFs

Managing a portfolio as if investors had all their money in it. (Morningstar)

Checking in on what is going on at Dimensional Fund Advisors. (Institutional Investor)

Do leveraged ETFs need stricter rules? (Marketwatch)

Global

“The euro’s crisis boils down to this: national treasuries do not have enough spare cash both to guarantee outstanding debt and maintain their own credit ratings. Even mighty Germany cannot stand alone behind the whole euro zone.” (Economist)

Eurozone bond yields continue higher, deal or no deal. (MarketBeat)

Don’t forget about Italy. (The Atlantic)

Economy

The return of the US consumer? (Pragmatic Capitalism)

Americans have stopped saving again. (Calculated Risk, Capital Spectator, Crackerjack Finance)

The ECRI WLI ticks up. (MarketBeat)

Modest growth an no recession. (Econbrowser, Bonddad Blog)

Don’t look now but the US is set to start exporting LNG. (The Source)

Earlier on Abnormal Returns

Doing yourself a favor by doing less. (Abnormal Returns)

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

A notable one year blogiversary. (Altucher Confidential)

Why don’t more bloggers sell links to marketers? (Megan McArdle)

A positive review of Emanuel Derman’s Models.Behaving.Badly.* (Bloomberg)

Abnormal Returns is a founding member of the StockTwits Blog Network.

*Amazon affiliate. You know the drill.