Quote of the day

Jose Ursua, “Over the long-run, however, high levels of home bias are likely to reveal diversification pitfalls that could be damaging for global investment portfolios.” (CNBC)

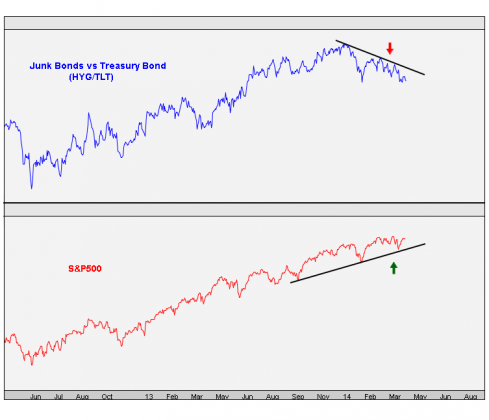

Chart of the day

The stock and bond markets seem to be in disagreement. (All Star Charts)

Markets

Bond closed-end funds are still looking higher. (McClellan Financial)

Don’t forget the US was once an emerging market. (Above the Market)

Market participants can’t believe Treasury yields are down YTD. (FT)

Strategy

A look at the global minimum variance portfolio. (Capital Spectator)

Why aren’t their more value funds? (A Wealth of Common Sense)

Companies

Amazon ($AMZN) is testing its own delivery network in San Francisco. (WSJ, Recode)

On the future of the Apple ($AAPL) iPad. (stratchery)

What American corporations are doing with their cash. (Bloomberg)

Why do public companies hold larger cash balances than private companies? (SSRN)

Finance

Why Warren Buffett’s position on Coca Cola’s ($KO) compensation plan is so disappointing. (Vitalily Katsenelson)

Are shareholder activists all that more short-term than other players? (FT Alphaville)

KKR ($KKR) wants to make it easier for secondary trading of private equity funds. (WSJ)

On the rise of crowdfunding. (Quartz)

Global

A look at the “incredible” round-trip in Spanish government bond yields. (Pragmatic Capitalism)

Would you rather own Brazilian or Russian bonds? (Bloomberg View)

One winner in the Ukraine mess: the Moscow Exchange. (Quartz)

Japan has only done so much to get inflation higher. (Sober Look)

Economy

GDP isn’t perfect but we still don’t have another, better measure. (The Week)

Nine economic charts from the week worth revisiting. (Quartz)

Earlier on Abnormal Returns

What you may have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

How Chipotle ($CMG) is refining the science of burrito building. (Quartz)

Taco Bell is going upscale with the US Taco Company. (Businessweek)

Why the US doesn’t produce limes any more. (Time)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.