Quote of the day

Barry Ritholtz, “Investing is really about imagining your future self — when you are older, working less or not at all, earning much less money…The ability to think far into the future — years and decades — is not something that comes easy. But it is essential in order to be a successful investor.” (Big Picture)

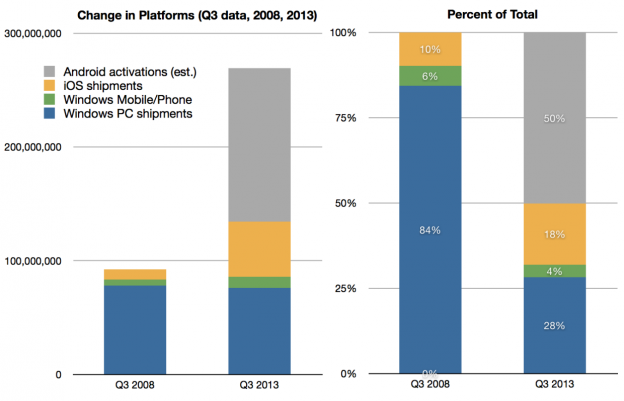

Chart of the day

How Microsoft ($MSFT) lost its platform dominance. (Asymco)

Markets

Free optionality in the markets is a rare thing. (Aleph Blog)

Bill Fleckenstein thinks the time is right to get back into the short selling game. (TheStreet via TRB)

Strategy

Cap-weighted indices are prone to concentration risk. (Mebane Faber, Alliance Bernstein)

Swapping one risk for another is no small matter. (Capital Spectator)

In defense of managed futures. (Peter Brandt)

Why being small can help you as an investor. (Motley Fool)

The benefits of going to investment conferences. (StockCharts Blog)

Companies

Oil and gas companies are taking advantage of the open IPO window. (WSJ)

Agrium ($AGU) looks cheap. (In Pursuit of Value also Market Folly)

Should cable companies build a Netflix ($NFLX) killer? (Quartz)

Aereo keeps beating the broadcasters in court. (Time)

IPOs

IPO success is measured in years, not minutes. (Pando Daily)

Recent IPOs are not necessarily operating at a profit. (WSJ)

The Royal Mail IPO pops on the open. Second guessing begins. (Bloomberg, Financial news)

Finance

Aswath Damodaran, “Twitter can be a good trade and a bad investment at exactly the same time!” (Musings on Markets)

A profile of Jeffrey Ubben who is taking on Microsoft ($MSFT). (Term Sheet)

Nasdaq wants you to test your strategies on their computers. (Businessweek)

ETFs

The ETF Deathwatch for October 2013. (Invest with an Edge)

Do you really want a hedge fund wrapped in an ETF? The AdvisorShares Sunrise Global Multi-Strategy ETF ($MULT) to launch soon. (IndexUniverse)

Economy

The existential risk of a government default. (NYTimes)

How Janet Yellen could improve on Fed communications policies. (Felix Salmon)

Earlier on Abnormal Returns

What you may have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

Computers don’t understand sarcasm very well. (FT)

Everyone agrees financial literacy is important just not not how to do it. (Time)

The Wolf of Wall Street by Martin Scorcese looks like a must-see Fall movie. (WSJ)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.