Quote of the day

Charles Rotblut, “(S)ome investments are often pitched to benefit the seller or the company facilitating the transaction, not the investor. This is why just because you can buy an investment, does not mean you should.” (AAII)

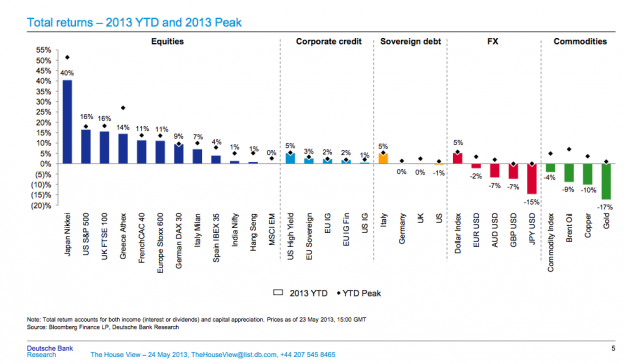

Chart of the day

Year-to-date asset class returns. (@matthewphilips)

Markets

The long awaited correction is here. (Charts etc.)

Jeff Miller, “Blaming the Fed is a fig leaf for bad analysis.” (A Dash of Insight)

Hedged country funds, now Germany, are a hot new thing. (IndexUniverse)

Strategy

What you need to do to claim you are an accomplished trader. (Price Action Lab via @reformedbroker)

On the ridiculous nature of asset-based fees. (Bason Asset)

Paul Tudor Jones steps in it. (Washington Post, FT Alphaville, Dealbook, Bloomberg)

Companies

Google ($GOOG) has some serious Amazon ($AMZN) envy. (WSJ)

CEOs coming out of retirement is the new, new thing. (Quartz, NYTimes, WSJ)

Tesla ($TSLA) is not exactly free of government support. (Daniel Gross)

Finance

It’s hard being a “proxy adviser” these days. (WSJ, Dealbreaker)

Companies need to speak up about flash crashes. (Themis Trading)

First year banking analysts are a hot commodity. (Dealbook)

The SEC may soon be back up to full strength. (InvestmentNews)

Options

Is it time to do away with big dividend-related options trades. (WSJ)

Here’s another threat to options volume: a unified tax policy on derivatives. (MoneyBeat)

Global

Australia took it on the chin this week. (MacroBusiness, Money Game)

The potential for upside Eurozone surprises. (Sober Look)

What’s next for the Greek economy? (MoneyBeat)

Economy

Economic numbers were pretty good this week. (Money Game)

Where did all the infrastructure spending go? (Wonkblog, Money Game)

What if the labor force participation rate flattens out? (Calculated Risk)

Listen to Bernanke, not the regional Fed presidents. (Tim Duy)

Stop paying so much attention to Ben Bernanke. (Anatole Kaletsky)

Mixed media

The Atlas of Public Stocks is now live. (Simoleon Sense)

Waze is the hot new Internet company in play. (Atlantic Wire, GigaOM)

Used iPhones are a big business. (Businessweek)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.