Quote of the day

Dan Greenhaus, “If the central bank stays accommodative and earnings keep doing what they’re doing, why not?” (Business Insider)

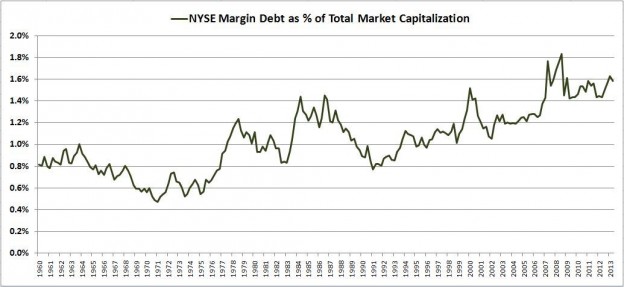

Chart of the day

The only margin debt chart that matters. (Philosophical Economics)

Markets

Q3 earnings are not exactly coming in too strong. (Bespoke)

Norway’s sovereign wealth fund is backing away from stocks. (Bloomberg also FT)

People are trading VIX options like crazy. (Attain Capital)

Strategy

The problem with focusing on dividends or share buybacks. (Mebane Faber)

Notes from the Excellence in Investing Conference: San Francisco 2013. (Market Folly)

How to create more signal and less noise. (Big Picture)

More information does not necessarily lead to better decisions. (Larry Swedroe)

Prudent diversification is time-dependent. (FT)

Companies

Why the iPad still rules the tablet universe. (Farhad Manjoo)

There are two very different tablet computing markets. (Benedict Evans)

Why we need more competition in Office-type apps. (Pando Daily)

Time to recheck your Netflix ($NFLX) valuation. (Pando Daily)

Twitter ($TWTR) sets its IPO price range below were people were expecting. (Dealbook, WSJ, Howard Lindzon)

Why is Twitter spending so much on R&D? (Term Sheet)

Where Twitter’s valuation sits compared to competitors. (The Reformed Broker)

Finance

A new stock exchange is trying to put all traders on a more equal footing. How it works. (Quartz)

The hottest hedge fund category is one that does not hedge at all. (II Alpha)

DuPont ($DD) is spinning off its performance chemical unit. (WSJ, Dealbook)

ETFs

The muni bond fire sale is over for now. (Focus on Funds)

Could an ETF price war get ugly? (Chuck Jaffe)

Global

The UK is growing again. (Business Insider, Economist)

Good news! Inflation in Japan is surging. (FT)

The Aussie dollar has bottomed. What comes next? (Market Anthropology)

The existential threat to the global sugar industry. (FT Alphaville)

Economy

“Economic activity dropped considerably due to the government shutdown.” (Econbrowser also Politico)

Trucks are rolling. Homeowners are remodeling. (Calculated Risk, NAHB)

What is the best way to teach financial literacy? (Bloomberg)

Earlier on Abnormal Returns

What you may have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

Startups are the new college these days, and not in a good way. (Pando Daily)

Should high schools be six years not four? (Time)

What it takes to get PhDs to think like entrepreneurs. (Businessweek)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.