Quote of the day

Chuck Jaffe, “(T)here’s no such thing as a “risk-free return,” and that it’s not some “right now” problem based on the level of the market or the lousy returns of bonds, but that it’s about how risk works.” (Marketwatch)

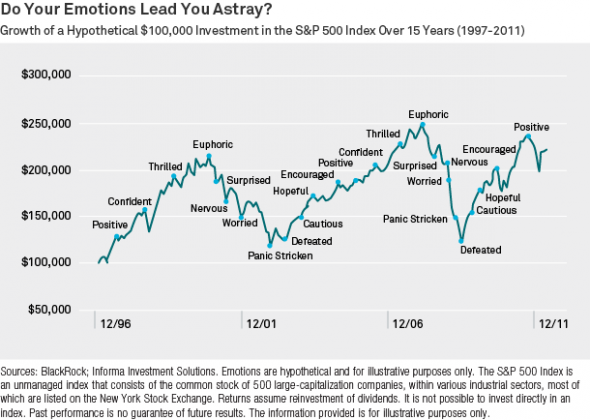

Chart of the day

The emotional investing roller coaster. (Blackrock via TRB)

Markets

On the growing divergence between crude oil and energy equities. (Charts etc.)

Checking in on a global equity allocation. (Capital Spectator)

Day of the month seasonality for June. (MarketSci Blog)

Strategy

The greatest investment book ever written may surprise you. (The Brooklyn Investor)

Why you never learn from your investing mistakes. (Motley Fool)

Practical lessons in assessing exotic risks. (Bronte Capital)

Companies

Maybe Apple ($AAPL) should listen less to Wall Street and be more like Google. (ReadWrite)

Regulations be damned, banks are doing just fine. (The Daily Beast)

Finance

Peer-to-peer lending needs a new name. (Economist)

Virtual currencies have an anonymity problem. (FT also Pando Daily)

Portfolio overlap: it is not just a problem for individuals. (WSJ)

Wall Street

College kids still want to work for Goldman Sachs ($GS) if only for the summer. (FT, FT Alphaville)

On the death of mentorship on Wall Street. (Big Picture)

Wall Street is sending their college recruits to “boot camp” to get up to speed. (Dealbook)

On the rise of the “earning to give” movement. (Wonkblog)

ETFs

The SPDR Blackstone/GSO Senior Loan ETF ($SRLN) is the most successful ETF launch YTD. (IndexUniverse)

Global

Emerging market currencies are taking it on the chin of late. (MoneyBeat)

Have you looked London real estate prices lately? (Marketwatch)

The youth unemployment picture in Europe is truly scary. (The Atlantic)

Economy

Consumer sentiment and Chicago manufacturing showed improvements. (Calculated Risk, Bespoke)

US consumers are doing just fine. (Quartz, Calculated Risk)

On the fears that the economy is actually accelerating. (NYTimes)

GDP vs. GDI: a tale of the tape. (FT Alphaville)

Private construction of health care facilities has flattened out. (Slate)

Earlier on Abnormal Returns

May you live in un-interesting investing times. (Abnormal Returns)

Mixed media

How safe is recreational marijuana? (Scientific American)

Does drinking beer make you more creative? (Fast Company)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.