Quote of the day

Kid Dynamite, “(I)f you want to mature as a trader/investor/thinker, seek out opposing viewpoints, not confirming ones.” (Kid Dynamite)

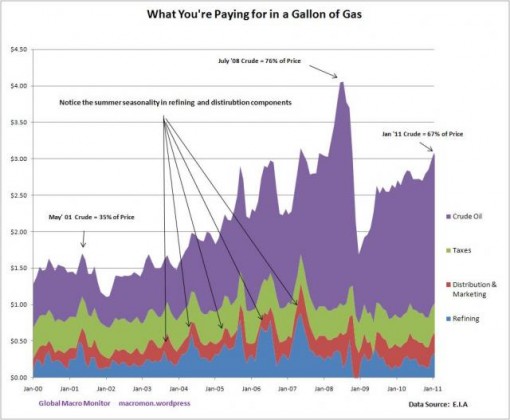

Chart of the day

What you are paying for a gallon of gas. (Global Macro Monitor)

Markets

“The market” never says anything intelligent over the short run. (ValuePlays)

How high will gasoline prices go? (Pragmatic Capitalism)

The US distressed debt market is picked over. Are there better opportunities in Europe? (Distressed Debt Investing)

Strategy

Trading is a “game of survival.” (Au.Tra.Sy blog)

On the value of being able take time off from trading, i.e. when you are sick as a dog. (The Minimalist Trader)

Infrastructure as an asset class is still in its infancy. (All About Alpha)

Should small investors try to emulate Warren Buffett’s investing style? (DailyFinance)

Companies

Google (GOOG) is very much a market stock these days. (the research puzzle)

It seems like Apple (AAPL) wants to get cloud-friendly in music. (Bloomberg)

Who is going to make what from the re-IPO of HCA? (WSJ)

Futures

Forex firm IPOs have not been a sure thing for their investors. (WSJ)

While volume shifts to forex futures traded on the CME (CME). (WSJ)

A clue as to how much futures volume is algorithmically-driven. (FT Alphaville)

Finance

Wall Street still loves a good write-off. (Jeff Matthews Is Not Making This Up)

No hedge fund is immune from a visit from the Feds. (Clusterstock)

Real estate investing is becomingly increasingly globalized. (beyondbrics)

Global

What countries are most at risk to a spike in oil pries. (The Source)

What is the effect of large scale currency appreciations? (voxEU)

Economy

A decent employment report. (Calculated Risk, Mark Thoma, EconomPic Data, Felix Salmon, Floyd Norris, Free exchange)

Does there need to be a government guarantee for the mortgage business to operate effectively? (NYTimes)

Just how sensitive is the Federal budget deficit to higher interest rates? (FT Alphaville)

How much froth is there in the boom in farmland prices? (NYTimes)

Earlier on Abnormal Returns

Our Friday morning live link look-in. (Abnormal Returns)

Taking note of the Ray Dalio appearance on CNBC yesterday. (Abnormal Returns)

Errata

Happy trails one of our favorite economic blogs. (EconomPic Data)

Mina Kimes, “In 1994, Duff McKagan’s pancreas exploded.” Now he manages money. (Fortune, Dealbreaker)

Abnormal Returns is a founding member of the StockTwits Blog Network.