Quote of the day

James Picerno, “The point is that rebalancing when you’ve earned a year or two worth of gains in a few months is usually a smart decision.” (Capital Spectator)

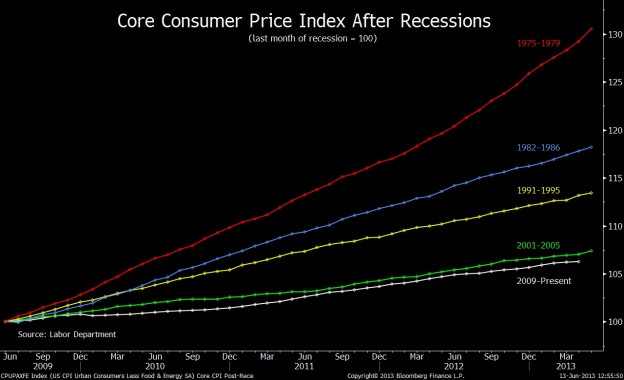

Chart of the day

No inflation to see here. (Big Picture)

Markets

Where did all the bond sales go? (FT)

Are Millenials coming back to the stock market? (Term Sheet)

It is hard to see where earnings growth is going to come from. (MoneyBeat)

Strategy

Traders can only control their own actions/reactions. (Trader Habits, Dragonfly Capital)

Wes Gray, “Arbitrage-like strategies always look easy on paper, but the devil is in the details.” (Turnkey Analyst)

On the difference between the possible and probable. (Big Picture)

Finance

Automated block trading is now a thing. (Reuters)

Everything you need to know about floating rate Treasury notes. (Institutional Investor)

Can we use a new securitization model to transform the drug discovery business? (Buttonwood)

Selling early access to data is not illegal. (Prof. Bainbridge)

Funds

What is behind Bruce Berkowitz’s big bet on Fannie and Freddie. (Term Sheet)

Blackrock ($BLK) can’t seem to get its equity unit right. (WSJ)

Global

Emerging market bonds are still held hostage to US rates. (HedgeWorld)

Why you can’t treat all emerging markets as the same. (The Telegraph)

Economy

Industrial production was flat in May. (Calculated Risk, Capital Spectator)

The markets too Bernanke’s May comments to heart. Now the Fed is walking them back a bit. (Dealbook, Real Time Economics)

Signs are now pointing towards a tapering decision in September. (Tim Duy)

Rail traffic is stagnating. (Pragmatic Capitalism)

Mortgages

Jumbo mortgage rates are now lower than conforming loans. (The Basis Point)

Mortgage refis have screeched to a halt. (WSJ)

Earlier on Abnormal Returns

Check out a wide-ranging interview with Tadas Viskanta. (See It Market)

What you may have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

People are drinking a lot less orange juice these days. (Quartz)

Beverage containers are going high tech. (Time)

Corn is the new wheat. (WSJ)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.