Quote of the day

Josh Brown, “Software is good, smart people employing software is better.” (The Reformed Broker)

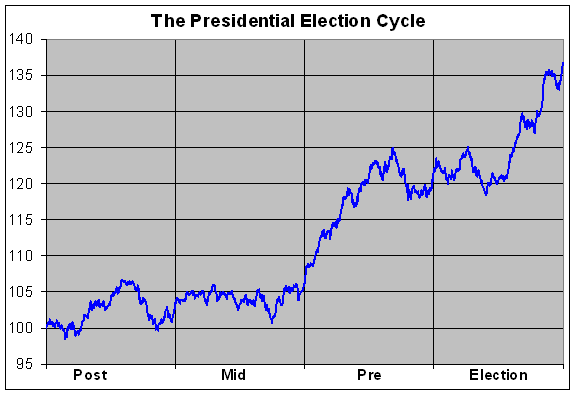

Chart of the day

Cross your fingers and hope the Presidential election cycle kicks in as it has historically. (Crossing Wall Street)

Markets

Don’t kid yourself, “the day-to-day action is nearly all noise.” (Big Picture)

You can’t react to the market unless you have a plan. (Kid Dynamite)

The ‘death cross‘ ain’t what it used to be. (Mark Hulbert)

Operation Twist has very real effects on the underlying dynamics of the repo market. (FT)

Strategy

On the rise of tactical asset allocation. (Nerd’s Eye View)

Move aside ‘Sell in May’ there is an “autumn effect” in gold. (SSRN via @jasonzweigwsj)

Does the use of moving averages help relatives strength strategies? (Systematic Relative Strength)

As long as active managers exist, low volatility strategies should work. (iShares Blog)

Technology

Tertiary plays on Facebook ($FB) got the worst of it. (research puzzle pix)

The case for the new and improved Demand Media ($DMD). (SumZero)

Finance

Shrugs all around for the Moody’s downgrade of the big banks. (Dealbreaker, Bloomberg, Sober Look)

Money market mutual funds were a big cause of the financial crisis. (The Brooklyn Investor)

Building a better brokerage…with software. (Alex Fry via @newrulesinvest)

Hedge funds

Hedge fund managers filing with the SEC don’t want you to know which fund is which. (WSJ)

Emerging hedge fund managers outperform their larger peers. (All About Alpha)

ETFs

Bank loan funds will one of these days be an ETF darling. (LearnBonds, FBN)

The road to converting existing mutual funds into ETFs is going to be a tough one. (ETF Trends)

Global

Germany can’t save the Euro. (Credit Writedowns)

The German economic miracle can’t withstand the weakness in Europe. (Money Game)

All Euro summits end with the use of the ECB’s balance sheet. (Gavyn Davies also The Atlantic)

Canadian authorities are girding against the country’s housing bubble. (Sober Look)

Economy

Why Ben Bernanke’s Fed is taking baby steps. (Real Time Economics)

Negative economic surprises are making for another summer of trouble. (Sober Look)

No signs of economic weakness here. (Value Plays)

Inflation is slowing and why that is bad. (Bonddad Blog)

Why aren’t the Feds supporting the use of natural gas as a transportation fuel? (Floyd Norris)

Rail traffic continues to improve albeit slowly. (Pragmatic Capitalism)

Ricardo was right. (MIT)

Earlier on Abnormal Returns

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

Michael Martin talks with Maneet Ahuja about her new book The Alpha Masters: Unlocking the Genius of the World’s Top Hedge Funds. (MartinKronicle)

Daniel Gross talks with June Thomas about Better, Stronger, Faster: The Myth of American Decline … and the Rise of a New Economy. (Slate)

A review of Scott Patterson’s Dark Pools: High-Speed Traders, A.I. Bandits, and the Threat to the Global Financial System. (Fortune)

Abnormal Returns is a founding member of the StockTwits Blog Network.