Quote of the day

Daniel Gross, “In fact, financial engineering has turned solar into a rather conservative, low-risk investment.” (Slate)

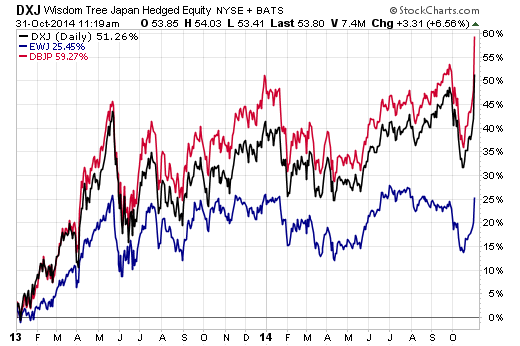

Chart of the day

A big day for Japan ETFs. (ETF)

Markets

QE may be done in the US, but overseas…. (The Reformed Broker)

Don’t think the bear market in gold and silver is near done. (Behavioral Macro)

Market tops take time to form. (Chris Perruna)

Companies

Starbucks ($SBUX) rules the mobile payments roost. (FT)

How Apple ($AAPL) Pay could transform in-app purchases. (Pando Daily)

How the market ruined Twitter ($TWTR). (Justin Fox)

How to make money off space exploration. (Daniel Nadler)

It’s a brave new world when a one-year old startup can capture a $1 billion valuation. (Digits)

Finance

Matt Levine, “The trick is not to try to compete with professional investors in your investing, any more than you compete with professional surgeons when you need surgery…” (Bloomberg View)

It is hard for private equity firms to shine when exits are limited. (WSJ)

Global

The Bank of Japan is doubling down on QE. (FT, FT Alphaville, Buttonwood)

Some scary global economic charts. (Quartz, Wonkblog)

Are post-crisis economic recoveries always slow? (MoneyBeat)

Economy

Some preliminary 2015 housing forecasts. (Calculated Risk)

Earlier on Abnormal Returns

Podcast Friday features a talk with a guy who is taking on Google ($GOOG) in search. (Abnormal Returns)

Q&A with Tobias Carlisle author of Deep Value: Why Activist Investors and Other Contrarians Battle for Control of Losing Corporations. (Abnormal Returns)

What you might have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

7 lifehacks to boost your productivity. (Mental Floss)

Women with more children are more productive at work. (Wonkblog)

People who have kids after 35 are happiest. (Quartz)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.