Quote of the day

Michael Bigger, “Most of the best traders I have met, trade spreads.” (Bigger Capital)

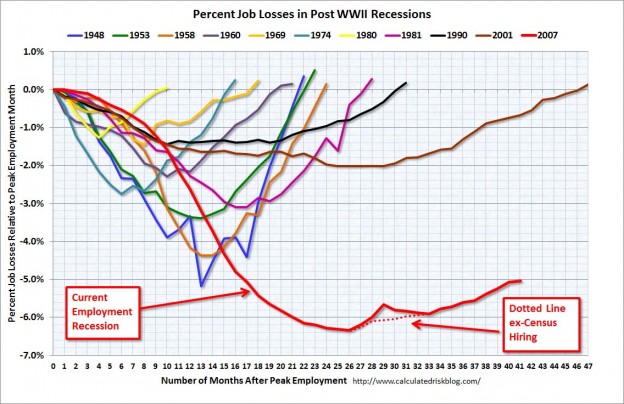

Chart of the day

An oldie, but a not-so-goodie, the jobs recession to-date. (Calculated Risk)

Markets

A rare early in the month market set-up. (Quantifiable Edges)

What happens after a five-week market losing streak? (Bespoke)

Risk appetites are rapidly waning. (Pragmatic Capitalism)

Why isn’t the VIX higher? (MarketBeat)

Look at that, a rally in the United State Natural Gas Fund (UNG). (Bespoke)

Strategy

Three ways to accelerate your trading education. (Tyler’s Trading)

Priority #1 is always managing risk. (All Star Charts)

Infrastructure investments are not all that different than other equities. (All About Alpha)

Making tech investing easy: buy innovators, sell laggards. (TechInsidr)

Tom Brakke, “Trying to represent an investment process visually is rather difficult; it’s tough to capture the process and still have a page/slide work effectively within a presentation.” (the research puzzle)

Shorting

The costliest stocks to short. (MarketBeat)

Take note when demand for shares to short picks up. (Empirical Finance Blog)

Finance

The last word on the IPO pricing “scandal.” (Interfluidity)

When execs make themselves scare, an IPO is imminent. (TechCrunch)

Just how much do the big banks rely on government support. (NetNet)

Should investors worry about money market mutual funds? (WSJ)

Regulate banks more closely before you start on money market mutual funds. (Aleph Blog)

How big a deal is the rise in settlement failures? (FT Alphaville)

Global

The big futures exchanges are expanding their product lines globally. (FT)

Five misconceptions debunked. (Credit Writedowns)

What a Greek default would look like. (Megan McArdle)

Chinese stock scandals are not limited to the US, the case of Sino-Forest Corp. (MarketBeat, Bronte Capital, Globe Investor)

Economy

Hard to put a positive spin on today’s non-farm payroll numbers. (Calculated Risk, Money Game, FT, Free exchange, Planet Money, Felix Salmon, Mark Thoma, ValuePlays)

The ISM Services index bounces. (Fund My Mutual Fund, Real Time Economics)

Implied inflation keeps trending lower. (Capital Spectator)

Now Moody’s is contemplating a downgrade of the USA. (MarketBeat, FT Alphaville)

You knew this had to happen eventually. Amazon.com (AMZN) and other e-retailers may have to start collecting sales taxes. (Businessweek)

The US is out of the Chrysler business. (Washington Post)

Earlier on Abnormal Returns

Is the US economy simply slowing or headed for a double-dip recession? (AR Screencast)

ARTV on investor education in an increasingly myopic world. (Abnormal Returns)

What you missed in our big Friday morning linkfest. (Abnormal Returns)

The ultimate (and newly revised) Groupon IPO linkfest. (Abnormal Returns)

Mixed media

Five especially prime footnote disclosures from Michelle Leder. (Daily Ticker)

Russ Roberts talks with Tim Harford about the “virtue of failure.” (EconTalk)

Abnormal Returns is a founding member of the StockTwits Blog Network.