‘Tis the season: Amazon Smile is giving $20 to your favorite charity when you buy a Kindle Fire HDX during the next week.

Quote of the day

Brad Feld, “Sometimes you have to stop doing things to make more progress.” (FeldThoughts)

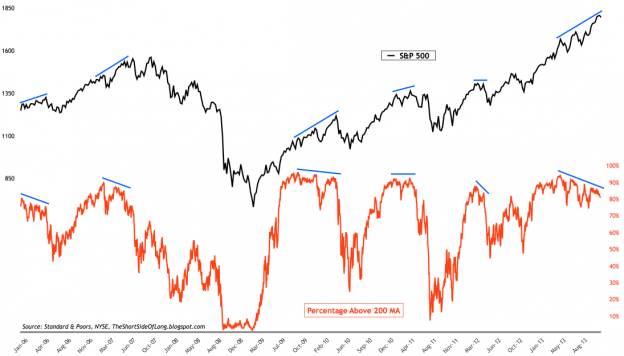

Chart of the day

S&P 500 breadth continues to deteriorate. (The Short Side of Long)

Markets

Market bellwethers are rolling over. (Charts etc.)

The case for REITs. (SurlyTrader)

Affluent investors are holding onto cash like a security blanket. (FT)

Options skew is elevated. (The Short Side of Long)

Hedge funds

Hedge funds are getting crushed in 2013 by the runaway S&P 500. (Bloomberg)

Seth Klarman and David Tepper are returning cash to investors. (II Alpha, ibid)

Investors are pulling money from Eddie Lampert’s hedge fund. (Dealbook, WSJ)

Sears Holdings ($SHLD) is spinning off Land’s End. (Reuters)

Strategy

Why we should expose ourselves to opposing viewpoints. (Above the Market)

Options selling has not been a rough road the past few years. (research puzzle pix)

Why current retirement withdrawal strategies need a rethink. (Rekenthaler Report, InvestmentNews)

Technology

Palantir is now valued in excess of $9 billion. (Businessweek, Bits)

AngelList is the Nasdaq of our generation. (Andreas Klinger via @mattermark)

There are too many damn messaging apps. (TechCrunch)

ETFs

How big a problem is index-frontrunning. (IndexUniverse)

A closer look at the Cambria Foreign Shareholder Yield ETF ($FYLD). (TheStreet)

Where investors put their money in 2013. (Focus on Funds)

Global

Spanish stocks are overvalued. (FT Alphaville)

South Africa is getting crushed by the reversal of the commodity cycle. (Sober Look)

The case for greater public investment. (Economist)

Economy

The November non-farms payroll report surprises to the upside. (Calculated Risk, Capital Spectator, Daniel Gross, Felix Salmon, Bonddad Blog)

How the Fed will read the NFP report. (Real Time Economics, MoneyBeat)

Rail traffic is chugging along. (Pragmatic Capitalism)

Corporate profits just keep on increasing. (Calafia Beach Pundit)

The evolving nature of men in the US workforce. (Political Calculations)

Earlier on Abnormal Returns

Simplify your investing to avoid ‘opportunities for failure‘. (Abnormal Returns)

What you may have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

Bitcoin fraud is a thing. (Dealbook)

American teens are still watching television. (The Atlantic)

What the Lightning adapter says about Apple ($AAPL). (Daring Fireball)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.