Today’s linkfest represents the post #4002 on Abnormal Returns. Thanks for your continued support!

Quote of the day

Rajiv Sethi, “A great deal of trading activity in financial markets is privately profitable but wasteful in the aggregate, since it involves a shuffling of net returns with no discernible effect on production or economic growth.” (Rajiv Sethi)

Chart of the day

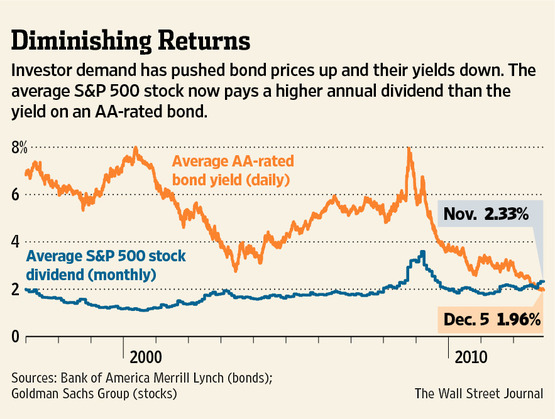

May you live interesting times: the S&P500 now comfortably yields more than AA rated bonds. (WSJ)

Markets

Three bearish signs. (Pragmatic Capitalism)

The German and French markets have broken out. (Global Macro Monitor)

Gloomy investment books highlight poor investor sentiment. (Globe and Mail)

Strategy

How to take advantage of the disposition effect. (Empiritage)

Is it possible to profit from quarter-end window dressing? (Dealbreaker)

Trends

Are we ever going to see another Warren Buffett? (The Daily Beast)

Some advisers are using technical analysis. (Financial Advisor)

When did failure become so acceptable? (Brian Lund)

Alternatives

Ready or not, alternative investments are going mainstream. (Financial Advisor)

Blackstone ($BX) is getting into retail funds. (FINalternatives)

Companies

Why breaking up HP ($HPQ) makes sense. (Breakingviews)

Is Facebook ($FB) a valid way for companies to disseminate information? (Kid Dynamite, Dealbook, FT Alphaville, AllThingsD, Dealbreaker, Above the Market)

Companies, including Poker Stars, are jockeying to profit from online gambling. (WSJ)

Finance

Why it pays to read the footnotes: a $210 billion error. (Alea)

Why equity investors continue to shun the big banks. (Free exchange)

Do hedge fund of funds have a future? (All About Alpha)

Don’t expect more Chinese companies listing in the US any time soon. (NYTimes)

Funds

Everybody is setting up ultra-short bond funds. (FT)

Institutional investors are moving beyond plain-vanilla indices. (Institutional Investor)

The ETF Deathwatch for December 2012. (Invest With and Edge)

The SEC is going to allow the use of derivatives in actively managed ETFs. (IndexUniverse)

Economy

A surprisingly good, post-Sandy, non-farm payrolls number. (Calculated Risk, Quartz, Felix Salmon, Bonddad Blog, Free exchange)

How will the Fed unwind its balance sheet? (Bloomberg)

How aging baby boomers affect the federal budget. (NYTimes)

The Mississippi River is at-risk of becoming unnavigable. (Businessweek)

Books

A liberal arts investor’s reading list from Tim Richards the author of The Zeitgeist Investor. (The Psy-Fi Blog)

A holiday gift guide for financial professionals including The Alpha Masters: Unlocking the Genius of the World’s Top Hedge Funds by Maneet Ahuja. (Market Folly)

The best books of 2012 including The New Industrial Revolution: Consumers, Globalisation and the End of Mass Production by Peter Marsh. (Economist)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.