Quote of the day

“Knowing when to do less, or do nothing is as important as knowing when to do something.” (Dynamic Hedge)

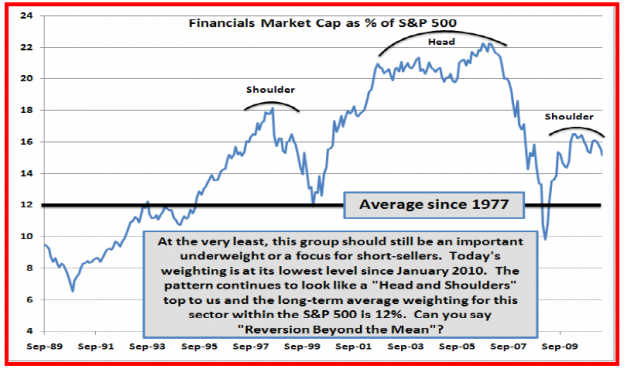

Chart of the day

Financial market cap as a percentage of the S&P 500. (John Rogue via Big Picture)

Markets

Equities vs. credit and the M&A cycle. (Pragmatic Capitalism)

P/Es matter even for hot IPOs like LinkedIn. (ValuePlays)

Why some people still like to play stocks in bankruptcy. (Businessweek)

Maybe this is why analysts don’t issue sell ratings. They rarely work out. (Bloomberg)

Muni bonds

Post-Whitney there still are opportunities at the long end of the muni curve. (Big Picture)

Did the Build America Bonds program work, and if so why won’t it be renewed? (FT Alphaville)

Meredith Whitney should have learned you can predict price (or in this case defaults), or time, but not both. (Bloomberg also Big Picture)

Strategy

Six important lessons culled from Peter Brandt’s Diary of a Professional Commodity Trader. (Crosshairs Trader)

What Peter Thiel is up to these days. (Dealbook)

Too many funds spoil the [401(k)] broth. (SSRN)

Is the value effect a compensation for risk? (SSRN via CXOAG)

Companies

The valuation case for Cisco (CSCO). (The Tech Trade)

Domino’s Pizza (DPZ) seems to have pulled off a turnaround. (Daily Ticker)

More on the deal to buy Barnes & Noble (BKS). (Deal Journal, Dealbook)

Is Whitney Tilson going to regret his short of SalesForce.com (CRM)? (TechInsidr also ValuePlays)

Blackrock (BLK) is 50% larger than its nearest rival State Street (STT). (Breakingviews)

Goldman Sachs (GS) stock has gone nowhere relative to the market for some five years now. (research puzzle pix)

Funds

SAC Capital is opening a new quant fund as the flagship fund closes to new investment. (Bloomberg)

You do not want to be a hedge fund manager on the wrong side of insider trading charges these days. (NYTimes)

Hedge funds that also allow for separate accounts don’t give up anything performance-wise. (All About Alpha)

Josh Brown, “(T)he IPO window has not only opened – investors have just tossed a trash can through it.” (The Reformed Broker also GigaOM)

It’s tough for hot IPOs to initially maintain their momentum. (Ivanhoff Capital)

Russia’s Yandex is the next hot IPO coming to market. (Reuters, Businessweek)

What LinkedIn means for the private markets. (Street Sweep)

LinkedIn as utility. (Howard Lindzon)

LinkedIn is a real company, but no one really knows what it is worth. (SAI)

Dual class shares and a slew of options make valuing LinkedIn more challenging. (Musings on Markets)

Global

Spanish yield spreads are back on the rise. (MarketBeat)

Germany vs. China: compare and contrast their economies. (Money Game)

Economist who forecast currency rates focus on growth and inflation. (Free exchange)

Economy

A look at CRB vs. CPI. (Dragonfly Capital)

Rail traffic is holding up okay. (ValuePlays)

Keep an eye the drop on TIPS-derived inflation expectations. (Capital Spectator)

The US Treasury has been extending its debt maturity profile for some time now. (FT)

Want to goose the economy? Fix the tax system. (macroblog)

Earlier on Abnormal Returns

ARTV with Jeff Miller of A Dash of Insight. (Abnormal Returns)

What you missed in our Friday morning linkfest. (Abnormal Returns)

The ultimate LinkedIn (LNKD) linkfest. (Abnormal Returns)

Mixed media

eBooks are not perfect, but they don’t need to be to supplant print. (Megan McArdle)

No wonder college is so expensive. It now takes most graduates more than four years to graduate. (Economix)

What is hindsight bias? (Farnam Street)

Contrary to popular belief it only takes 50 baseball games to sort the winners from the losers. (WSJ)

Abnormal Returns is a founding member of the StockTwits Blog Network.