You often hear the expression “you make your own luck.” The idea being that by changing your attitude and outlook you can change behaviors and ultimately outcomes. This post by Fred Wilson at A VC reminded me of the real-world evidence behind this idea. In short, a resilient attitude and positive outlook can help turn bad luck into good.

This is all well and good when it comes to our personal and professional lives. However the financial markets have their own approach to luck and it is not so forgiving. Recently Barry Ritholtz spoke with Michael Mauboussin, author of The Success Equation: Untangling Skill and Luck in Business, Sports, and Investing about the role of skill and luck in investing. In it they talk about the “paradox of skill” where the increasing skill and sophistication money managers bring to the table today has made it all the more difficult to generate positive alpha. This phenomenon makes it all the more puzzling why investors, especially institutions, continue to pay active management fees for sub-market performance.

Luck clearly plays a role in how managers perform. However there is another way in which luck plays a role in investor outcomes. Michael Batnick at The Irrelevant Investor recently noted just how awful the performance of the broad stock market was in the decade of the 2000s. You have to look to the 1970s or 1930s to find a worse period of performance. Batnick used this evidence to encourage Millennial investors to look down the road to better times ahead.

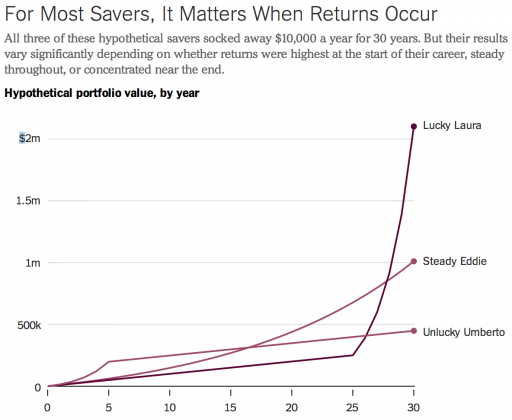

These decade-long periods of poor market performance can greatly affect how an investor experiences retirement. Neil Irwin writing at The Upshot has a great article on how it is that the timing of market returns is as important to our ultimate outcomes as it the average returns we experience. Irwin notes that younger investor shouldn’t necessarily cheer the rising stock market. The returns that occur when you already have a nest egg in place matter for more in absolute dollar terms then the actual annual returns. The chart below shows how the timing returns on terminal wealth.

Source: NYTimes.com

Luck therefore is clearly going to play a role in our investing lives. Taking an index-centric approach to fund selection can help reduce the risk of manager-specific shortfalls. Another way in which investors can help take luck out of the equation is diversification. Morgan Housel at the Motley Fool talks about how diversification can help offset the risk of a bad decade for any particular asset class. He writes:

Having a mix of stocks, bonds, cash, and real estate can reduce the risk of having all your assets in one investment that suffers a bad decade. A lot of the results in these charts can be explained by a simple factor: stock valuations at the end of the period were either in a bubble or a bust. Diversification can offer protection from extremes.

Diversifying your portfolio is an important factor in reducing the drag of volatility in retirement. Chris Marx and Kent Hargis at AllianceBernstein have an interesting piece showing how portfolio volatility in retirement, when you are withdrawing funds, can increase the risk of a shortfall. Not only does lower volatility reduce the risk of bad outcomes it also increases the chances you, the investor, will be able to stick with your plans.

There is another more fundamental way of trying to offset the risk of bad market outcomes in (and near) retirement. Ben Carlson at A Wealth of Common Sense has a post up showing the power of increased saving rates to help offset lower market returns. He shows that no matter how you structure your portfolio from an asset allocation perspective increased savings is valuable in generating higher terminal wealth. He writes:

The point is that saving more money reduces risk, regardless of if you define risk as owning more stocks or running out of money.

That is ultimately the risk we all fear: running out of money. We cannot predict with any degree of certainty where the financial markets will stand when we ultimately enter retirement. This is really just plain, inter-generational luck. What we can do is try to offset the risk of poor market outcomes through our own behaviors. This includes boring, personal finance 101 stuff like indexing, diversifying your portfolio and increasing your savings rate.*

In our personal lives it seems that a positive attitude can help make us more open the possibility of luck. Unfortunately in the financial markets luck is a much more intractable problem. However we investors can take some steps to help offset the risks of poor outcomes. Luckily they are all things we can accomplish on our own or with the help of a financial advisor so long as you get started early. Nobody can predict where the stock market will be a year from now let alone thirty years from now. All you can do is to control what you can and avoid making big mistakes like confusing activity with results.

*There is some potential to use valuation indicators over very long periods of time and within the context of retirement planning. See this discussion by Michael Kitces.

Items mentioned above:

Get lucky. (A VC)

Barry Ritholtz interviews Michael Mauboussin. (Soundcloud)

The Success Equation: Untangling Skill and Luck in Business, Sports, and Investing by Michael Mauboussin. (Amazon)

Alpha and the paradox of skill. (Credit Suisse)

Practice makes imperfect. (Buttonwood)

The 2000s were the worst decade for investors. (The Irrelevant Investor)

Why a soaring stock market is wasted on the young. (The Upshot)

The hard truth: successful investing involves a lot of luck. (Motley Fool)

Volatility in retirement – what a drag! (AllianceBernstein)

A simple approach to saving rates. (A Wealth of Common Sense)

Compound experience not just interest. (The Reformed Broker)

Shiller CAPE market valuation: terrible for market timing, but valuable for long-term retirement planning. (Nerd’s Eye View)