The goal of every investor is to generate real, after-tax returns. Pretty simple stuff. The financial media spends most of its time talking about nominal returns. In a very real sense inflation and taxes play just as important a role on investor outcomes. We don’t spend a lot of time talking about inflation rates and tax laws because the evolve much more slowly than market returns. Therefore our attention is drawn to market returns which as we all know are volatile.

It therefore is easy for investors to become complacent about inflation. (Let’s leave aside taxes for this discussion.) Ever since the end of rampant inflation in the 1970s and early 80s, inflation by and large has been off the table as a issue for investors and the economy. A peek at TIPS-derived inflation expectations shows inflation bouncing around 2%.

Source: Real Time Economics

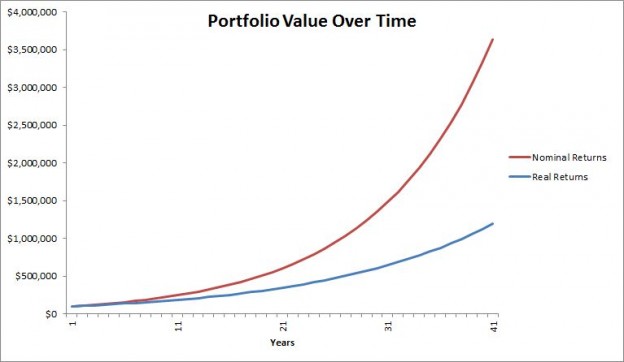

This view of inflation unfortunately misses the bigger picture. 2%, let alone 3%, inflation over the lifetime of an investor compounds at a pretty good clip. Mebane Faber at World Beta in the chart below shows the difference between a 9.4% nominal return and the returns less 3% inflation. As you can see the difference this makes compounded over a lifetime of investing.

Faber goes on to talk about the challenge inflation poses to investors in balanced portfolios, let alone those trying to make a go of things in cash equivalents:

Even investing in a 60/40 portfolio is only expected to return around 3% a year in real terms while STILL exposing investors to 70% losses. These strategies should all be seen as simply strategies to keep up with inflation. That is depressing of course, but true. The worst outcome is the cash under the mattress strategy which will expose the investor to anywhere from 2% to 7% losses per year. You may not notice the effects, kind of like a boiling frog, but at some point you look back and say, “wow, I remember when a Coke cost 25 cents….”

A lot of investors these days are holding large cash balances in the hope of riding out current market volatility. The problem is with the return on cash hovering around 0% in nominal terms and -2% in real terms, if you believe the inflation expectations, this puts investors in a pretty deep hole. Investors, like Jeremy Grantham at GMO in his most recent quarterly letter, recognize this issue but still recommend holding cash.

Try to avoid duration risk in bonds. For the long term they are desperately unattractive. Don’t be too proud (or short-term greedy) to have substantial cash reserves. Admittedly, this is the point where we at GMO try to be clever and do a little better than the minus 1% real from real cash – and, so far, with decent success.

Inflation never really went away as an issue for investors. What went away are decent, low-risk options to try to keep up with inflation. The Fed’s policy of zero interest rates has made difficult choices for investors. Unfortunately no let up seems imminent. All the while inflation is still the silent killer of investor portfolios, compounding away in the background.