If you are a market geek then you need to check out the Credit Suisse Global Investment Returns Yearbook 2011. The yearbook is driven by data compiled by Dimson, Marsh and Staunton who are well known for their work in analyzing long market return time series.

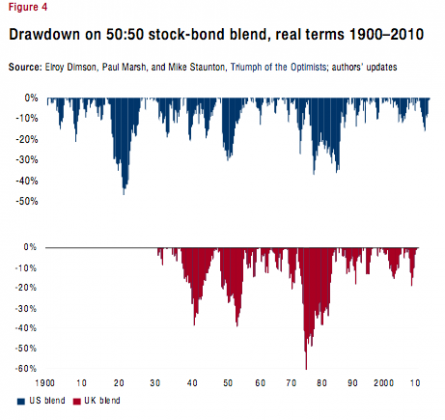

Mebane Faber at World Beta has a couple of posts up today that highlight some data from the report. The first being a post that highlights the power of dividend yield on country selection. The second shows the real drawdowns investors would have experienced in US (and UK) equities and bonds since 1900.

We were drawn to these charts because they highlight two themes we have harped on previously. The first is that dividends matter. The second is that stocks and bonds are likely riskier than most investors believe. One thing that mitigated these market drawdowns not surprisingly turned out be diversification.

Source: Credit Suisse Global Investment Yearbook 2011, p. 7

In any event the whole thing is worth checking out including the return analysis of nearly twenty countries.