Quote of the day

TRI, “Knowing that you don’t know is among the most important aspects of investing, for both professional and non-pro investors. The most financially dangerous response to an information vacuum is to reach desperately for a framework that makes things intelligible. It is particularly dangerous to grab at one that just happens to fit your personal politically ideology.” (Interloper)

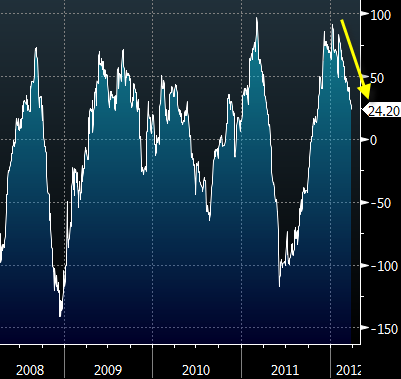

Chart of the day

The Citigroup economic surprise index is now trending down. (Sober Look)

Markets

Want to know where the market stands? Check out the banks. (Market Anthropology)

Hedge funds are long equities and getting longer. (Money Game)

Investor sentiment: still elevated. (The Technical Take)

Equity markets are still betting on the consumer. (Humble Student of the Markets)

Should Treasury investors worry about rising Bund yields? (Pragmatic Capitalism)

Strategy

On the importance of internalizing your stop loss method. (Brian Lund)

Beta is not volatility. (Portfolio Probe)

When do beta-arbitrage strategies work and why? (SSRN via @quantivity)

Backstage Wall Street

Why Henry Blodget gets a pass in Backstage Wall Street. (The Reformed Broker)

Analyst research is a “big joke.” (FT Alphaville)

Financial advisers

Do financial advisers reinforce bad investor behaviors? (NBER)

Is is time for a replacement for the 401(k)? (Time)

Clients say the funniest things. (I Heart Wall Street)

Companies

Is Google ($GOOG) unable to succeed in social because it’s engineers are too smart? (SAI)

Is Accenture ($ACN) worth a premium to IBM ($IBM)? (YCharts Blog)

Apple ($AAPL) vs. ExxonMobil ($XOM): a market cap comparison. (Bespoke)

Finance

In defense of Jon Corzine. (Dealbook, FT Alphaville)

Banks 2: Volcker Rule 0. (Bloomberg, Finance Addict)

Bankruptcy claims are getting the SecondMarket treatment. (Distressed Debt Investing)

The money management business needs a good disruption. (Big Picture)

Funds

Prime brokers are passing along higher financing charges to hedge fund clients. (FT)

Another not-so satisfied customer of Goldman Sachs ($GS). (NYTimes)

Hedge fund bigfoots who are backing Mitt Romney. (Fortune)

ETFs

Why do we have leveraged ETFs? (Zero Hedge)

How the Goodhaven Fund got off the ground. (Morningstar)

Global

Dilution and the attraction of Asian equities. (beyondbrics)

A look at the new Greek yield curve. (Sober Look)

Economy

The Chicago Fed National Activity Index shows average economic growth. (Capital Spectator, Calculated Risk)

Government debt and the recurring feature of bubbles in modern capital markets. (Modeled Behavior)

Comparing the Great Recession to past recesions. (Econbrowser)

Changing lanes

Americans are saying no to higher prices at the pump. (Sober Look)

Young Americans don’t seem to be as interested in buying a car. (The Atlantic)

Behavioral economics

On the rise of “forensic economics.” (Tim Harford)

This whole behavioral economics thing might actually work. (Free exchange)

Earlier on Abnormal Returns

Retail forex follies. (Abnormal Returns)

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

Research into the StockTwits stream as a predictor. (Howard Lindzon)

Seeking Alpha passes one million registered users. (Tradestreaming)

Congratulations on seven years of blogging to New Deal Democrat. (Bonddad Blog)

Abnormal Returns is a founding member of the StockTwits Blog Network.