Quote of the day

Howard Lindzon, “People are going to trade and people are going to hate stocks.” (Howard Lindzon)

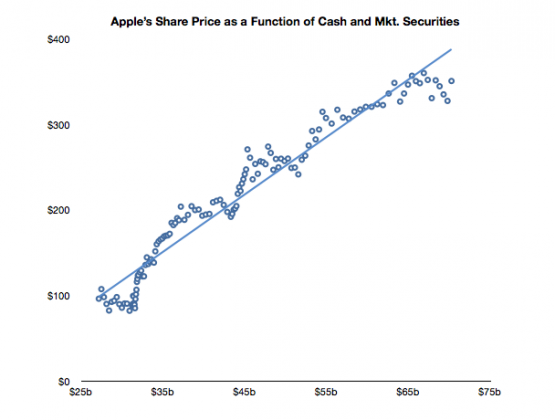

Chart of the day

The market only seems to care about Apple’s (AAPL) cash. (Asymco)

Markets

It was hard to lose in the global capital markets in April. (Capital Spectator, Bloomberg)

What a ‘peace dividend‘ looks like. (The Reformed Broker)

Companies, especially big ones, continue to beat earnings expectations. (Bespoke)

The stock market looks overbought. (Capital Observer)

April was a good month for trend followers. (Au.Tra.Sy Blog)

Silver

Average True Range for silver has exploded. (Afraid to Trade)

Take note of the surge in silver trading. (Peter L. Brandt)

Parabolic markets, like silver, experience some pretty nasty reversals. (Market Anthropology)

Why do physical buyers of gold and silver buy one coin over another? (Kid Dynamite)

Pawn shops are big winners in the run up in silver. (NYTimes)

Some commodities have already turned down. (WSJ)

Strategy

The ‘scuttlebutt method‘ of stock research. (Bronte Capital)

What has happened historically after the stock market has experienced “overvalued, overbought, overbullish, rising-yields syndrome“? (Money Game, Hussman Funds)

Squaring the use of fundamentals and technicals. (Stock Sage)

An academic study in support of a simple technical strategy. (Empirical Finance Blog)

Individual TIPS vs. TIPS funds. (WSJ)

Finance

Buffett is letting it ride on Goldman Sachs (GS). (Bloomberg)

Just in case you thought Dodd-Frank was the answer to anything. (WSJ)

Banks aren’t lending because they are still dealing with their bad loans. (The Daily Ticker)

Funds

Do the benefits of levered ETFs outweigh their benefit? (Stone Street Advisors)

Why now is a good time to do your hedge fund due diligence. (NetNet)

A look at (falling) mutual fund expense ratios over time. (Morningstar)

David Einhorn likes Yahoo! (YHOO). (market folly)

Howard Marks

Notes from Howard Marks‘ talk at the Chicago Booth’s 6th Annual Distressed Investing and Restructuring Conference. (Distressed Debt Investing)

A review of Howard Marks‘ The Most Important Thing: Uncommon Sense for the Thoughtful Investor. (Reading the Markets)

Australia

Did you know Australia has a sub-5.0% unemployment rate? (Bloomberg)

The Aussie dollar is at all-time highs. (Data Diary, Bloomberg)

Housing demand can dry up in an instant. (MacroBusiness)

Economy

The ISM Manufacturing survey points towards continued growth (and inflation). (Bloomberg, Crossing Wall Street, CBP also Bespoke)

Why is no one doing anything about the unemployment crisis. (Project Syndicate, Economix also Econbrowser)

It seems like it is just a matter of time before the Fed tightens. (Economist’s View)

How well can prediction markets work with “imperfect information”? (Economix)

Earlier on Abnormal Returns

It’s the first trading day in May, but does it mean ‘sell in May‘ as well? (AR Screencast)

Baruch is back and is advocating for the return of Peter Lynch-style individual investors. (Abnormal Returns)

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

The middle class in Africa has increased 60% in the past decade. (WSJ)

Heidi Grant Halvorson, “Believing that the road to success will be rocky leads to greater success because it forces you to take action.” (HBR)

Abnormal Returns is a founding member of the StockTwits Blog Network.