Quote of the day

James Surowiecki, “It’s easy to understand why savers feel like collateral damage in the Fed’s fight against recession, but too much sympathy for their plight is dangerous.” (New Yorker)

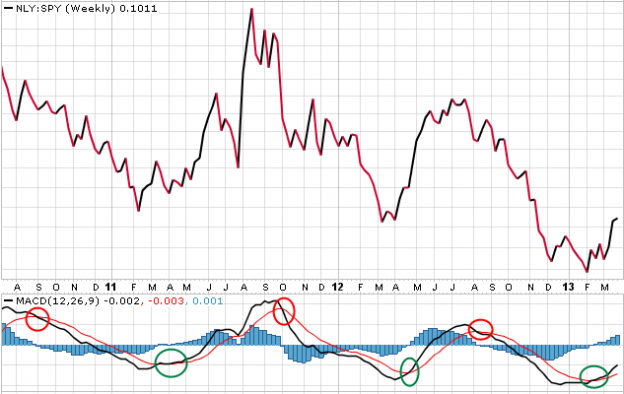

Chart of the day

Using mortgage REITs to time the market. (Charts etc.)

Markets

Checking in on major asset class performance in March. (Capital Spectator)

Dividends continue to rise. (Crossing Wall Street)

Sell-side strategists are still bearish. (Big Picture)

Stocks and bonds are moving in different directions. (Price Action Lab)

Fighting the Fed has become fighting the world. (WSJ)

Personal finance

Budgeting isn’t fun, but is necessary. (Bucks Blog)

10 things your financial adviser won’t tell you. (Marketwatch)

What good is the family office? (Phil Demuth)

Commodities

The case for a bounce back in corn prices. (Sober Look)

Investors are turning their backs on commodities. (WSJ)

Finance

Who are current securities laws really protecting? (Howard Lindzon)

Who is winning the Herbalife ($HLF) battle? (WSJ)

Ever more volume continues to shift to dark pools. (NYTimes)

Banks

Bank boards are not underpaid. (Dealbook)

Banks are finally slowing their branch expansion. (WSJ)

Bankers are finding jobs in online gaming. (FT)

ETFs

Checking in with ETF pure play WisdomTree Investments ($WETF). (InvestmentNews)

A brief history of the ETF. (John Bogle)

Global

March has been tough on the European economy. (Money Game)

Chinese manufacturing is picking up. (FT also BCA Research)

Brazil and India both have inflation problems. (Bonddad Blog)

Economy

March ISM Manufacturing dropped back. (Calculated Risk, CBP)

David Stockman thinks the world is going to hell. (The Daily Beast, Wonkblog)

Mixed media

Crowdfunded products now need their own distributor. (Babbage)

The vitamin business is booming. (WSJ)

What Opening Day says about the current state of the country. (The Daily Beast, Conor Sen)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.