Quote of the day

Baruch, ” They are not positioned for a period of calmness, of things getting generally, modestly, better, for a market where buy and hold can work. They need to adapt again, or if not die, then potentially stagnate.” (Ultimi Barbarorum)

Chart of the day

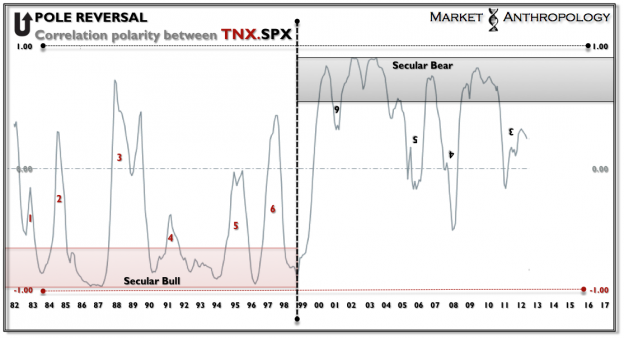

What it will take to move into a true bull market. (Market Anthropology)

Markets

Asset class performance over the past three years. (Bespoke)

Is the market consolidating or stalling? (Global Macro Monitor)

A first look at 2013 earnings estimates. (Crossing Wall Street)

Meredith Whitney was right. (Fortune)

Investor sentiment is still elevated. (The Technical Take)

Strategy

Five ways to think about diversification. (Bucks Blog)

Why smart investors fail to outpeform the market. (Rick Ferri)

Traders always need to have an emergency plan. (Dragonfly Capital)

Understanding the link between volatility and compound returns. (CSS Analytics)

A look at the returns to market timing via moving averages. (SSRN via @quantivity)

Companies

Why the iPad is so much more dominant than the iPhone in its category. (Big Picture)

Today’s Silicon Valley is not as virtuous as it would like you to think it is. (Newsweek)

Washington Post ($WPO) vs. New York Times ($NYT): who has the best strategy to survive? (Economic Principals)

Finance

Gulp. US bank dividends set to double. (FT)

Are MF Global “bonuses” really justified? (Finance Addict, WSJ)

Who is James J. Wang and how did he steer the Oceanside Fund to such high returns? (Fortune)

ETFs

The ETF Deathwatch for March comes in near 300 funds. (Invest With an Edge)

Why high yield bond ETFs have trouble tracking their benchmark. (FT)

Global

Financial repression is going nowhere any time soon. (Bloomberg)

Fixed asset investment in China is grinding to a halt. (Sober Look)

Sell G4 currencies, buy G16 currencies. (Money Game)

Economy

The US economy is embarking on a self-sustaining recovery. (James Surowiecki)

Three things the US economy needs to worry about. (The ArmoTrader)

Is the great economic rebalancing finally happening? (Money Game)

Is Okun’s Law broken? (WSJ)

Don’t expect much bang from sterilized purchases of long-term Treasuries. (Econbrowser)

Why innovation in the nuclear reactor business is so lacking. (Economist)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

Does the Web need a “curator’s code“? (NYTimes, brain pickings)

Brenda Jubin, “Backstage Wall Street is a quick-paced, well-written book by someone who’s been there and done some of that.” (Reading the Markets)

A nice review of Daron Acemoglu and James Robinson’s Why Nations Fail: The Origins of Peace, Prosperity and Poverty. (Guardian)

Abnormal Returns is a founding member of the StockTwits Blog Network.