Quote of the day

Fred Wilson, “Profits are critical to the health of a business, but that doesn’t mean a healthy business has to currently profitable.” (A VC also Om)

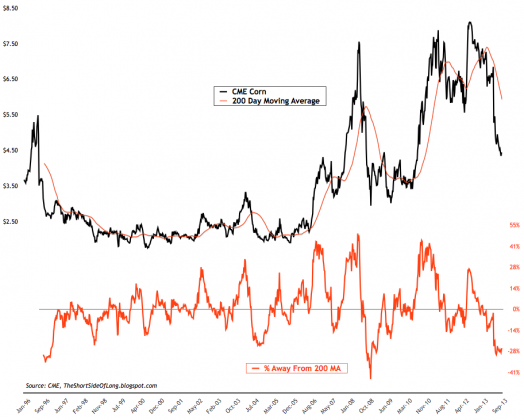

Chart of the day

Corn is way oversold. (The Short Side of Long)

Markets

In the long run valuation matters. (Mebane Faber)

Five signs of market froth. (Brett Arends)

Fund managers are bullish on Europe and bearish on emerging markets. (The Short Side of Long)

On the relationship between the 10 year and lumber prices. (See It Market)

Strategy

7 market lessons, relearned in 2013. (Ivanhoff Capital)

Sometimes buy-write strategies underperform, like this year. (Adam Warner, Condor Options)

Companies

Why is Coca-Cola ($KO) underperforming the market? (The Reformed Broker)

The case for Shutterstock ($SSTK). (Fortune)

What Apple ($AAPL) should do with its cash besides a big buyback? (WSJ)

Are cruise ships getting too big sail? (NYTimes)

Investors are sticking with Pandora ($P) for now. (Fortune)

Finance

How the Twitter ($TWTR) IPO will likely play out. (Aswath Damodaran also MoneyBeat)

Institutional landlords are not necessarily a bad thing. (Bloomberg)

Currency-focused hedge funds are going away. (Pensions & Investments)

Peer-to-peer lending is rapidly getting institutionalized. (FT)

ETFs

Why ETF sponsors are loath to close small funds. (Pensions & Investments)

The ten most (and least) popular ETFs in 2013. (IndexUniverse, ibid)

Why Fidelity launched sector ETFs. (Focus on Funds)

Economy

A look at Abenomics one year in. (Gavyn Davies)

Why isn’t inflation lower? (Econbrowser)

Earlier on Abnormal Returns

What you may have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

Sponsoring conferences have become money makers for media companies. (NYTimes)

The idea behind income-contingent loans is not going away. (James Surowiecki)

Nine valuable lessons from “rubbish jobs.” (FT)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.