Quote of the day

James Picerno, “The financial media’s agenda isn’t necessarily aligned with the best interests of investors…High-quality investment advice doesn’t lend itself to daily (or hourly) reinvention and a steady stream of new and dramatic headlines.” (Capital Spectator)

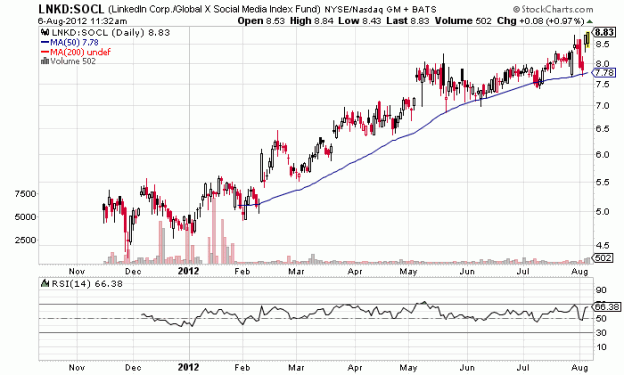

Chart of the day

Why has LinkedIn ($LNKD) done better than other social media IPOs? (peHUB)

Strategy

Investors can get into trouble focusing on chatter and not the charts. (All Star Charts)

Trying to identify “real expertise” is no small matter. (the research puzzle)

Institutional investors are not sure what to do with commodities. (Pensions & Investments)

What is going on with Treasury bond options volatility. (Condor Options)

Trading

How one trader got started in trading. (Brian Lund)

You have to find an edge in poker (and trading). (chessNwine)

Companies

The four three horsemen of the new economy. (Howard Lindzon)

How many iPhone 5s is Apple ($AAPL) going to sell? (Asymco)

A look at future Facebook ($FB) share lock-up expirations. (SAI)

Best Buy’s ($BBY) founder wants to buy the whole company. (Dealbook, ibid)

Radio stations have moved online in big way via apps. (NYTimes, Pando Daily)

Hedge funds

The hedge fund industry pushes back against Simon Lack’s The Hedge Fund Mirage. (FT, FT Alphaville)

Global macro funds were supposed to thrive on volatility, now not so much. (WSJ)

Do investors buy hedge funds for the prestige? (Macro Musings via @researchpuzzler)

Hedge funds are gearing up for opportunities in the financials. (FT)

Should you read The Little Book of Hedge Funds by Anthony Scaramucci? (The Reformed Broker)

Finance

There will be more trading mishaps as long as market structure remains flawed. (Points and Figures, Doug Kass, Felix Salmon)

The big banks are trying to cover their assets in the Libor probe. (Dealbook)

The Knight Capital ($KCG) rescue is finalized. (Reuters, Clusterstock)

On the dangers of relying on repo. (Felix Salmon)

Is Manchester United really an “emerging growth company”? (Finance Addict)

Social finance

What problem are online investment managers trying to solve? (Alex Fry)

What role can social networks have in getting investors on track? (The Psy-Fi Blog)

ETFs

Four ETF lessons learned from the Knight trading debacle. (IndexUniverse)

The chicken-or-egg problem of actively managed ETFs. (The Reformed Broker)

Mutual funds

My how the fortunes of Vanguard and American Funds have diverged. (WSJ)

What portfolio turnover tells us about mutual fund returns. (Morningstar)

What we can learn from how Vanguard fires managers. (Marketwatch)

Global

Draghi admits convertibility risk is real. What it means. (Gavyn Davies, WSJ)

What steps Europe needs to take to solve the crisis. (Money Game)

China has no problem letting the renminbi falling value. (beyondbrics)

Economy

These five indicators don’t show a recession on the horizon. (Carpe Diem)

Is the economy growing as fast as it can? (Econbrowser)

Why we should be worried about the rise in gasoline prices. (Political Calculations, Calculated Risk)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

What’s old is new again: long forgotten fish show up on restaurant menus. (Huffington Post)

Why you need a vacation. (The Atlantic)

Curiosity Rover lands safely on Mars. (Scientific American, LATimes, Bad Astronomy)

Abnormal Returns is a founding member of the StockTwits Blog Network.