Quote of the day

Barry Ritholtz, “And once you define everything as a hedge, well then, nothing is a hedge.” (Big Picture)

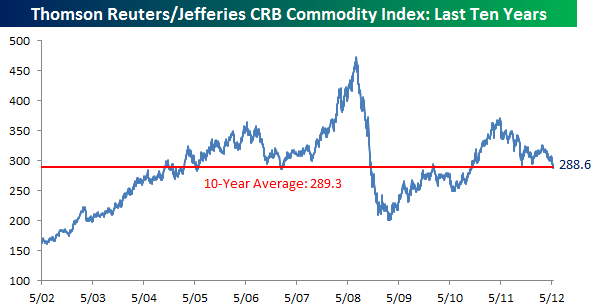

Chart of the day

Commodities prices are at new multi-year lows. (Bespoke)

Markets

The bears have everything going for them going into the Summer. (The Reformed Broker)

Thirteen overpriced stocks. (Crossing Wall Street)

One of these days Euro volatility is going to spike. (Investing With Options)

Strategy

How to bounce back from trading failure. (SMB Training)

The most common mistake investors make. (Portfolioist)

How random portfolios can help us measure fund performance. (Portfolio Probe)

The 2012 annual broker survey. (SmartMoney)

Are momentum strategies still profitable? (Empiritage)

An interview with James Berman who is creating “valuable mashups of investment research.” (Tradestreaming)

Gold

A great contrary indicator has switched from gold into bonds. (I Heart Wall Street)

What Peter Bernstein had to say about the history of gold. (Reading the Markets)

Companies

Why are tech companies like Zynga ($ZNGA) going public? To have a currency for acquisitions. (WSJ)

The economics of Android. (Asymco, ibid)

Drillers are switching from natural gas to oil. (WSJ)

Personal finance

How technology will improve financial planning. (Nerd’s Eye View, InvestmentNews)

Three keys to getting ahead. (EconLog)

What Eduardo Saverin owes America. (Pando Daily)

Are we sure Facebook ($FB) “gets” mobile? (Erick Jackson)

JP Morgan

The CDS market views JP Morgan ($JPM) and Berkshire Hathaway ($BRKA) as the same credit risk. (Sober Look, ibid)

More thoughts on the JP Morgan hedge issue. (Kid Dynamite)

Portfolio hedges often DO lose money. (Falkenblog)

Managing bloated bank investment portfolios and the Volcker Rule. (Dealbook)

Is the Fed to blame in part for JP Morgan’s folly. (Economic Musings also Term Sheet)

Funds

A category does not make a category of funds a buy. (Chuck Jaffe)

A better China ETF. (ETFdb)

Greece

Greece is sick and tired of austerity. (The Psy-Fi Blog, NYTimes)

Could Greece get kicked out of the Euro? (Credit Writedowns)

Global

The stunning spread in Euro industrial production. (Dr. Ed’s Blog)

The end of austerity could also mean the end of the Euro. (Bloomberg)

The risk of a hard landing in China. (Gavyn Davies also NYTimes)

Economy

Certainty is no sure thing when it comes to economic forecasting. (Capital Spectator)

Surging auto sales are likely to drive economic growth. (Bloomberg)

On the coming helium crisis. (Wonkblog)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

A guest post from me on why value investing works. (Old School Value)

Ask a distinguished panel of bloggers a question: win a copy of Abnormal Returns: Winning Strategies from the Frontlines of the Investment Blogosphere. What’s not to like? (Abnormal Returns)

Mixed media

The future of TV is on demand and multi-screen. (New York)

One of these days HBO’s model is going to stop working. (Pando Daily)

One of these days declining audiences are going to bite the networks. (NYTimes)

The man in Hollywood everyone wants to meet. (Newsweek)

Abnormal Returns is a founding member of the StockTwits Blog Network.