Quote of the day

Ben Carlson, “The real “perfect” portfolio is whatever approach allows you to stick with your investment plan without completely abandoning your strategy at the worst possible times.” (A Wealth of Common Sense)

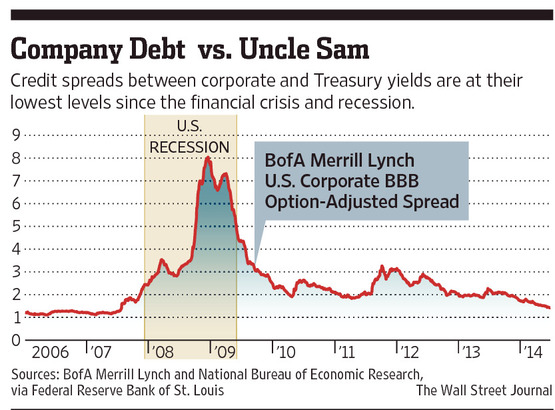

Chart of the day

Corporate credit spreads are at post-crisis lows. (WSJ)

Markets

A correction is coming (sometime) and you should view it as an opportunity. (Barry Ritholtz)

Why so many investors love to “chase winners.” (The Reformed Broker)

Why gold may not be all that great a hedge against inflation/higher rates. (Mark Hulbert)

Why corn prices have plunged in 2014. (Bloomberg)

Strategy

Why understanding what the “second trade” is so important. (All Star Charts)

Presentation matters: dollars vs. percentages. (WSJ)

Why “small wins” are important to your day. (TraderFeed)

Companies

The high cost of American companies moving overseas for tax purposes. (Fortune)

Are there more Heinz-like situations out there? (The Brooklyn Investor)

Meet the man who rescued the Hilton ($HLT) buyout. (WashingtonPost)

One positive for Blackberry ($BBRY). (Bonddad Blog)

Finance

The world of penny stocks is ‘rife with fraud.’ (WSJ)

Are “abusive short sellers” all that big a problem? (FT Alphaville)

Wall Street is fighting over a small cadre of recent graduates. (NYTimes also The Epicurean Dealmaker)

Why Wall Street may have the first “self-aware machines.” (The Mitrailleuse via MR)

Should asset managers be consider among the systematically important financial institutions? (FT)

IEX Group wants to put dark pools out of business. (WSJ)

ETFs

For better or worse we are in the golden age of backtesting. (Rekenthaler Report)

ETFs have changed the way we think about investing. (ETF)

The problem with target date mutual funds. (Pragmatic Capitalism)

iShares is not afraid to disrupt its own ETF cash cows. (ETF)

Economy

What is the nature of the bet on higher inflation longer term? (Tim Duy)

The longer you are expected the live the more investing in education makes sense. (Calculated Risk)

Eight lessons learned from the goings on at the Port of Los Angeles. (Quartz)

Earlier on Abnormal Returns

What you might have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

People prefer to tell things to a computer before their doctor. (Pacific Standard)

Kids don’t care about cars any more. (Lefsetz Letter)

Solar is set to disrupt the power grid. (Guardian)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.