Quote of the day

Roger Nusbaum, “A forever portfolio would be great but I don’t think it is practical.” (Random Roger)

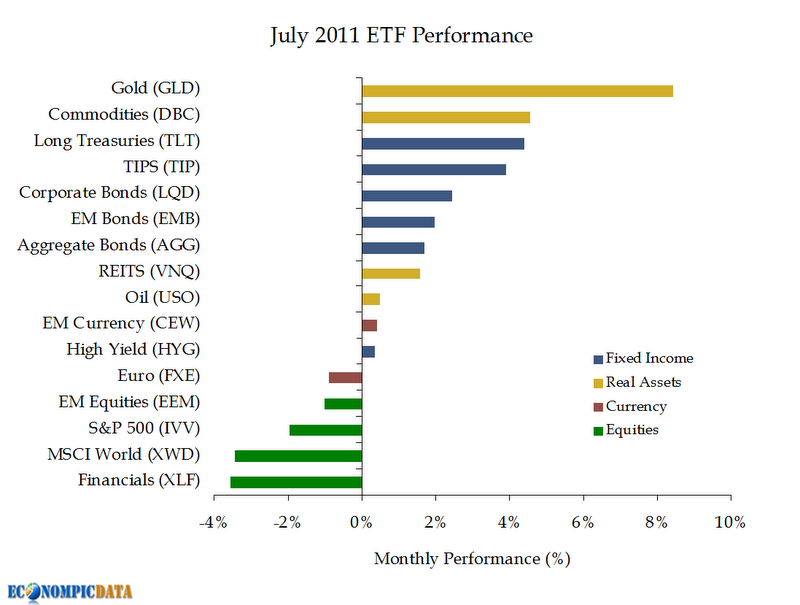

Chart of the day

July 2011 ETF Peformance. (EconomPic Data)

Markets

Major asset class performance in July. (Capital Spectator)

Utilities and energy continue to lead the sector race. (Dragonfly Capital)

Most indices are oversold based on the % of stocks above their 50 day moving average. (Kagi Trader)

The lost decade for stocks, revisited. (Crossing Wall Street)

Strategy

Who needs to get in the IPO when you know the end of the ‘quiet period‘. (WSJ)

Do budget deficits matter for stock market performance. (CXO Advisory Group)

Can large pension funds beat the market? (SSRN via FT)

Companies

Companies that are seeing signs of an economic slowdown. (Jeff Matthews)

A. O. Smith ($AOS) as a cheap play on a housing recovery. (YCharts)

Goldman Sachs ($GS) is losing friends left and right. (Clusterstock)

Are pure plays the future of big oil? (Fortune)

Used cars are the new new cars. (Reformed Broker)

The easy growth in smartphone sales is over. (Asymco)

Funds

Russell Investments pushes into bond ETFs. (IndexUniverse)

Like the Mets, Greenlight Capital ($GLRE) eked out positive returns in July. (Institutional Investor)

On the market for hedge fund-like mutual funds. (Marketwatch)

Looking back at just how much the mutual fund industry has changed over a lifetime. (research puzzle pix)

Economy

A disappointing ISM manufacturing index for July. (Calculated Risk, ValuePlays, Global Economic Intersection)

Restaurant traffic is picking up. (Calculated Risk)

Our national deficit problem in pictures. (Invictus)

What a decade of reaching for yield hath wrought. (Interfluidity)

Where economic growth comes from and why interest rates are so low. (Locklin on Science)

The current patent regime “makes us all poorer and helps keep us stuck in the great stagnation.” (Economist)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

Applying the “specialist’s dilemma” to business and investing. (FutureBlind via Farnam Street)

Benchmarks simplify, sometimes too much. (Portfolio Probe)

Why ‘personal brand building‘ has things backward. (The Guardian)

Abnormal Returns is a founding member of the StockTwits Blog Network.