Quote of the day

Howard Jones, “In US equities, one of the largest asset classes, investment consultants as an industry appear to add no value in fund selection..” (FT)

Chart of the day

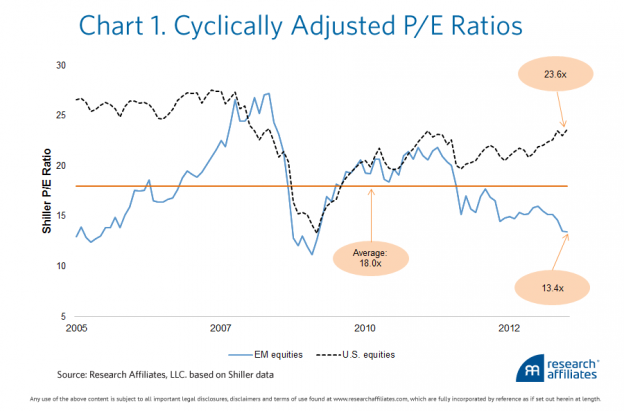

Emerging markets are priced attractively relative to the US. (Research Affiliates)

Markets

This week is historically a weak one. (Quantitative Edges)

Cyclical stocks continue to outperform. (Humble Student)

How to play a chaos-filled October in Washington. (Daniel Gross)

Strategy

The blind spot of the 60/40 portfolio. (Capital Spectator)

Market timing is a waste. (Rick Ferri)

How Monish Pabrai uses investment checklists. (Phil DeMuth)

Notes from the Alpha Hedge West Conference. (Market Folly)

Nine things investors don’t need. (Marketwatch)

Companies

The risk to LinkedIn ($LNKD): unbundling. (Ben Evans, A VC)

Why is Nokia ($NOK) paying its CEO $25 million? (Slate)

Apple ($AAPL) sold a lot of iPhone 5s this weekend. (TechCrunch)

Finance

How have prior social media IPOs done so far? (YCharts Blog)

Convertible bond issuance has slowed. (FT)

AngelList raises a big round. (Term Sheet)

Rich guys still read TheStreet.com ($TST). (Seeking Alpha)

Global

Why you should pay attention to what Raghuram Rajan is doing with Indian rates. (Quartz)

Can central banks ever afford to taper bond purchases? (FT Alphaville)

Economy

The Chicago Fed National Activity Index increased in August. (Calculated Risk)

Why the Fed should not be cavalier with its credibility. (Gavyn Davies)

The ways in which QE is damaging. (FT)

Did the Fed’s announcement leak earlier? (Quartz)

Earlier on Abnormal Returns

What you may have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

David Epstein author of The Sports Gene: Inside the Science of Extraordinary Athletic Performance talks with Russ Roberts. (EconTalk)

Yearing prices are back to pre-crisis levels. (WSJ)

Swedes love Brooklyn Brewery beer. (Bloomberg)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.