Quote of the day

George Magnus, “Put simply, the economic model that drove the long boom from the 1980s to 2008, has broken down.” (FT)

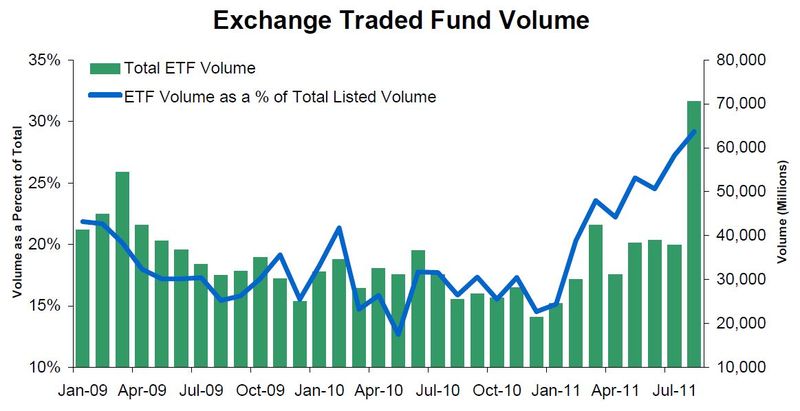

Chart of the day

No wonder everyone is talking about ETFs these days. (Ticker Sense)

Markets

Taking the long view on stocks paints a brighter picture. (WSJ contra Crossing Wall Street)

A look at a really long term trendline. (Market Anthropology)

Defensive sectors continue to lead the market. (Dragonfly Capital)

Stock market volatility is the new normal. (NYTimes, Big Picture, TRB)

The stock market can’t go up until inflation expectations stabilize. (Capital Spectator)

Strategy

Equity returns by credit rating. (Falkenblog, TRB)

Does indexing work in emerging markets? (CBS Moneywatch)

On the differences between professional and retail traders. (Trader Habits)

Companies

McGraw-Hill ($MHP) splits into two separate companies. (WSJ, Dealbook, Bloomberg)

Does Amazon ($AMZN) have it wrong when it comes to book rentals? (Minyanville)

The turnaround in Restoration Hardware. (Term Sheet)

Money management

Berkshire Hathaway ($BRKB) hires another investment manager. (Term Sheet, Bloomberg, Dealbook)

Where Bill Gross went wrong in 2011. (Bloomberg)

The September 2011 ETF Deathwatch is here. (Invest With An Edge)

Finance

What is Goldman Sachs ($GS) worth? (MarketBeat)

What role should private equity have in jobs equation? (peHUB)

What is Jamie Dimon talking about? (Felix Salmon)

Global

Events that were once “inconceivable” are now likely. (The Reformed Broker)

Country stock market performance YTD. (Bespoke)

A look at the value in German stocks. (Bloomberg)

The Euro crisis is coming to a head. (Felix Salmon)

Norway as a safe haven currency (or not). (Fund My Mutual Fund, The Source)

Want growth? Go to Turkey. (beyondbrics)

Economy

What do low interest rates signify? (Econbrowser)

What an ambitious mortgage refinancing program would look like. (Economist’s View)

Why housing still matters. (Bonddad Blog)

Why the Japanese case is not relevant to the US case. (China Financial Markets)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

News on the web is getting increasingly more niche. (NYTimes)

The hidden cost of a Groupon deal for business. (Technology Review via @danprimack)

Abnormal Returns is a founding member of the StockTwits Blog Network.