Quote of the day

Ben Thompson, “I think it [Minecraft] has the potential to continue to grow and, along the way, not only make Microsoft a whole bunch of money, but also enable an entire ecosystem. It really could be the Office of gaming.” (stratchery)

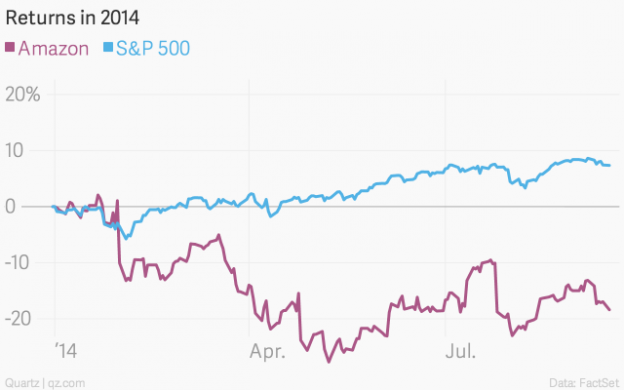

Chart of the day

Is Alibaba drawing attention from Amazon ($AMZN)? (Quartz)

Markets

Market bears are capitulating. (WSJ)

Should we be concerned about the surge in IPOs like Alibaba? (Lex)

Has the market already incorporated all the positive economic surprises? (Humble Student)

Strategy

How often do stocks and bonds fall together? (A Wealth of Common Sense)

Why some anomalies seem to persist. (Larry Swedroe)

On the dangers of chasing style performance. (Rick Ferri)

Quant stuff

How to use bootstrapping techniques when you are lacking returns data. (Capital Spectator)

In defense of a quantitative approach to the market. (Math Trading via TraderFeed)

On the advantages of mechanical strategies. (Systems Trader via Whole Street)

Wearables

Apple ($AAPL) is now a lifestyle company not a computer technology company. (Om Malik)

What is the “why” of the Apple Watch? (stratchery)

Don’t underestimate the potential of smartwatches and other wearables. (Chris Mims)

How companies could incorporate wearables. (TechCrunch)

Companies

Yahoo’s ($YHOO) time as an Alibaba ($BABA) proxy are almost over. (MicroFundy)

The Microsoft ($MSFT) deal for Minecraft is official. (Dealbook)

Where American companies are winning. (Howard Lindzon)

Finance

Bill Ackman is set to raise some $2 billion in permanent capital. (Dealbook, FT)

Global

Why everyone is nervous about slowing Chinese economic growth. (Sober Look also Quartz)

Non-US real estate generally has a lower correlation that domestic REITs. (Alliance Bernstein)

Economy

Why the Fed has plenty of time to turn the switch. (FT Alphaville)

A preview of this week’s FOMC meeting. (Calculated Risk)

Industrial production in August actually dropped. (GEI, Calculated Risk)

The fracking boom is bigger than anyone thought possible. (WSJ)

Earlier on Abnormal Returns

102 finance people you have to follow on Twitter. (Business Insider)

What you might have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

Here’s how to cancel a meeting the right way. (Mark Suster)

The twilight of the big management consulting firms. (FT)

The case against “on demand for everything.” (Recode)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.