Quote of the day

Rick Ferri, “Mr. Bogle may have issues with people who trade ETFs, but there is no question that this product has help promote his investment philosophy over the years.” (Rick Ferri)

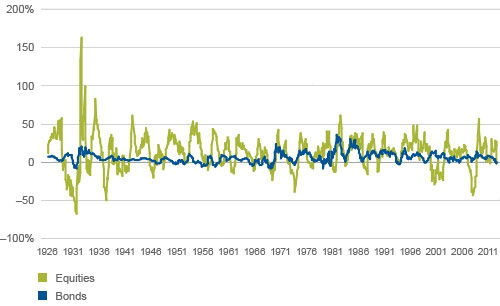

Chart of the day

Should investors still own bonds even when their prospective returns are low? (Vanguard Blog)

Markets

This market is operating on two different time frames. (Dynamic Hedge)

Stocks are losing momentum. (The Short Side of Long)

Government shutdown

Should investors care about a government shutdown? (Random Roger)

Key dates in the government shutdown/debt ceiling timeline. (FT Alphaville)

Putting a potential government shutdown in market perspective. (Charts etc.)

The motivations of a government shutdown. (Marginal Revolution)

This will not be the last government closure. (Simon Lack)

October

Should you revamp your portfolio because tomorrow is October? (The Reformed Broker)

Day of the month seasonality for October. (MarketSci Blog)

Investment advisors

A broad overview of social media technology for investment advisors. (Michael Kitces)

Five ways in which robo-advisors will change the way advisors work. (Practically Speaking)

Companies

Should Facebook ($FB) have its own venture capital arm? (TechCrunch)

Pandora ($P) should be worried about iTunes Radio. (CNet)

Apple ($AAPL) is now the world’s most valuable brand. (NYTimes)

IPOs

Twitter is expected to unveil its S-1 this week. (Quartz)

How much time do investor need to digest a S-1? (WSJ)

This fall will be filled with brand-name IPOs. (WSJ)

Finance

CLO issuance is at post-crisis highs. (FT)

The evolution of Lending Club. (Felix Salmon, ibid)

Startups

Are AngelList Syndicates all that big a deal? (Mark Suster)

What is the “best mechanism for amateur participation” in startups? (Chris Dixon)

Let the new crowdfunding market mature a bit before diving in. (Howard Lindzon)

Overviews of the debate over AngelList. (Business Insider, Pando Daily)

Funds

Pricing illiquid assets is an issue for mutual fund companies. (Chuck Jaffe)

On the prospects for ‘smart beta.’ (Portfolio Probe)

Global

Ten stealth economic trends that are ruling the world. (The Atlantic)

Global inflation is not an issue at present. (Pragmatic Capitalism)

World trade never really recovered from the Great Recession. (Gavyn Davies)

Economy

Why markets were so focused on taper talk. (Econbrowser)

Consumer should start feeling better as gasoline prices have fallen. (Calculated Risk)

Looking back at two years in at a prominent recession call. (Bonddad Blog)

Earlier on Abnormal Returns

What you may have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

Crises are not reserved for mid-life. (New Scientist)

How to use “microbursts” to increase your energy. (Fast Company)

Should scientists crowdfund? (Scientific American)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.