Quote of the day

Brett Steenbarger, “If we’re not regularly surprised by what we read and discuss, the odds are good that our brain’s diet has turned stale. And that’s a danger zone for confirmation bias.” (Big Picture)

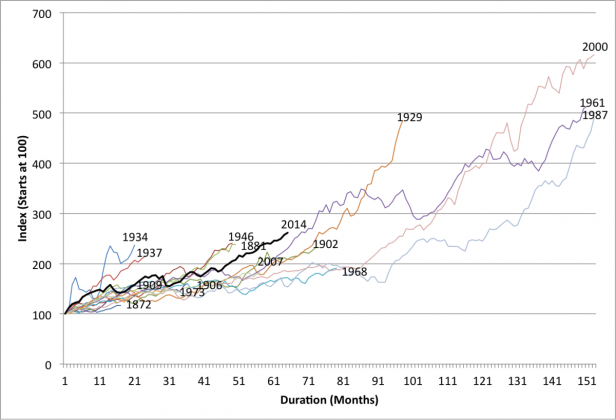

Chart of the day

A look at bull markets since 1871. (Greenbackd)

Video of the day

Jason Trennert talks with Consuelo Mack about the lack of alternatives to stocks. (Wealthtrack)

Markets

Joshua Brown, “My theory is that the activity and jostling for position inherent in a market regime shift like the one we’re now seeing is guaranteed to cause volatility.” (The Reformed Broker)

Junk bond illiquidity rears its ugly head. (WSJ, FT, TRB)

Markets experience big drops during bull markets. Get used to it. (Statistical Ideas)

Forex market volatility is at record lows. (MoneyBeat)

Strategy

Patrick O’Shaughnessy, “One of the reasons that indexing works is that it is so consistent. Its strategy (buy big stocks, the bigger the better) is mediocre, but it never veers off course.” (Patrick O’Shaughnessy)

A closer look at real world CANSLIM performance numbers. (A Wealth of Common Sense)

Individual investors now have all the tools they need to succeed. What they need now is better education and training. (TraderFeed)

Why you need to adjust the Sharpe Ratio on that backtested investment strategy. (SSRN)

Barry Ritholtz talks with Michael Mauboussin about luck (and skill) in investing. (Bloomberg View)

Companies

Is Apple ($AAPL) ready to move away from Intel ($INTC) chips on the Mac? (Monday Note)

Warren Buffett is sitting up on his largest cash pile. (Bloomberg)

Finance

Corporations now have $2 trillion more in debt than they did in 2007. (Brett Arends)

Wall Street is buying a messaging startup to bypass Bloomberg. (WSJ)

Valuing a portfolio has become increasingly complex, hence the need for startups to fill the gap. (NYTimes)

More non-traded REIT shenanigans. (Simon Lack)

Funds

Why would individual investors want to ape the returns of hedge funds? (Barry Ritholtz)

Just how good are the free alternatives to the robo-advisors? (Ari Weinberg)

Economy

The prime working age population is growing again. (Calculated Risk)

We have a big shortage of truck drivers. (Business Insider)

Earlier on Abnormal Returns

There really has never been a better time to be an individual investor. (Abnormal Returns)

What books Abnormal Returns readers purchased in July 2014. (Abnormal Returns)

What you might have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

How the Chinese mobile web differs from the US. (Benedict Evans)

Thinking about computer programming as a trade. (WSJ)

Pinterest is all about aspiration. (The Atlantic)

Startups love Gmail. (Quartz)

You can support Abnormal Returns by visiting Amazon. Don’t forget to follow us on StockTwits and Twitter.