Quote of the day

Gray, et al. “Overall, the evidence suggests that investors should always hold some portion of their portfolio in bonds. If an investor can truly predict the future of interest rates, they should start the next PIMCO.” (Empiritage)

Chart of the day

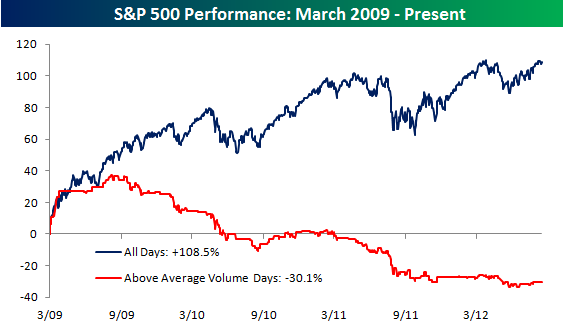

Why is everyone complaining about low volumes? (Bespoke)

Markets

On the strength of the current rally. (Big Picture)

Investors need to keep an eye on China. (Global Macro Monitor)

What’s driving gold higher of late? (Sober Look)

How hedge fund marketing is changing. (All About Alpha)

Strategy

A look at non-directional bond strategies. (Inside Investing)

Putting a model to rebalancing rules. (Capital Spectator)

The volatility of volatility helps explain equity returns. (Condor Options)

Average outcomes don’t necessarily from average inputs. (Aaron Brown)

Investing

Why investing is the hardest profession in the world. (John Standerfer via @howardlindzon)

Why value investors are kind of “anti-social” and a “pain in the ass.” (Interloper)

If you don’t have an investment philosophy, get one. (Rick Ferri)

On the rise of discount, or robo-advisers. (Financial Planning via Nerd’s Eye View)

Companies

AOL ($AOL) is giving shareholders back a big slug of cash. (WSJ)

Zynga ($ZNGA) as a call option on legalized online poker. (YCharts Blog also Grumpy Old Accountants)

Is Google ($GOOG) Apple’s ultimate target? (The Loop via DF)

Same day delivery is coming closer to reality. (AllThingsD)

Global

The US and European markets are increasing correlated. (Bespoke)

A reassuring look at the history of our economic problems. (Money Game)

A pause in the path towards Peak Cheap Oil. (Telegraph)

Economy

Another sign the housing recovery is real. (Pragmatic Capitalism)

A review the Fed’s actions post-crisis. (Econbrowser)

Midwest manufacturing is chugging along. (Carpe Diem)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

You cannot outsource your social media strategy or implementation. (The Reformed Broker)

Dave Pell, “Email is still the killer app.” (The Verge)

The ten most dangerous things business schools teach MBAs. (Eric Jackson)

Abnormal Returns is a founding member of the StockTwits Blog Network.