Quote of the day

Josh Brown, “They turned gold into a stock then were shocked when it started to act like one.” (Reformed Broker earlier Abnormal Returns)

Chart of the day

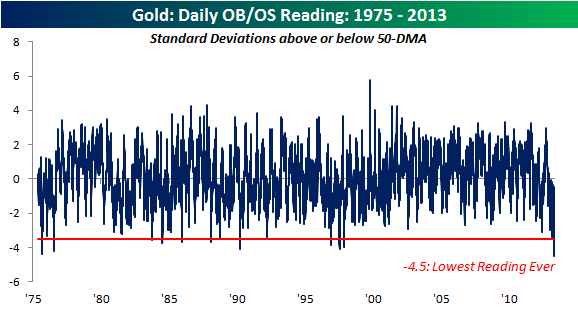

Take it with a grain of salt, but gold is now wicked oversold. (Bespoke)

Gold

Technical looks at gold. (AlphaTrends, The Short Side of Long)

Why the drop in gold prices is a good thing for the rest of us. (Money Game)

Gold has no fundamentals. (Big Picture)

On gold volatility. (Condor Options, MarketBeat)

A word of caution on buying in the face of panicked markets.* (chessNwine)

Gold=Bitcoin. (FT Alphaville)

Is gold money heading into Treasuries? (All Star Charts)

Markets

This quarter’s earnings are going to be tough to interpret. (A Dash of Insight)

The physics of investing in overvalued markets. (Greenbackd)

Using ETFs as a contrarian indicator. (Big Picture)

Strategy

Why commodities have little (or no) place in your portfolio. (Pragmatic Capitalism)

Investors’ number one problem is not saving enough. (Systematic Relative Strength)

The purpose of TIPS in a portfolio. (Rick Ferri)

Equity index trend following has become more difficult. (Price Action Lab)

Companies

What Ben Graham would like about Amazon ($AMZN). (Pando Daily)

Berkshire Hathaway ($BRKA) is now bigger than Warren Buffett. (BeyondProxy)

The television industry is under attack on all sides. (NYTimes)

Dish Networks ($DISH) bids for Sprint ($S). (Bloomberg, Quartz, Pando Daily)

Finance

The ten highest paid hedge fund managers. (Dealbook)

A look at the rise (and fall) of the big global commodity traders. (FT, ibid)

Why pension funds are hooked on private equity. (Time)

Dividend payers are the hot new IPO candidates. (Fortune)

ETFs

What ETFs are (and are not). (Bucks Blog)

John Bogle on why we need a total corporate bond ETF. (IndexUniverse)

Are you getting your money’s worth for the fund fees you pay? (Chuck Jaffe)

Global

Increasing credit is not generating much Chinese growth. (FT Alphaville, Quartz)

Japanese investors are looking abroad for returns/yield. (WSJ)

The US is “envious” of the German labor market. (FT)

Canadian households continue to deleverage. (Sober Look)

Economy

Why long-term unemployment is so scary. (The Atlantic)

There is no iron law that land prices have to rise along with population. (Noahpinion)

On the stunning rise in student debt. (Econbrowser)

Why David Stockman gets so much play in the media. (James Surowiecki)

Mixed media

Why your brain craves music. (Time)

Even without alcohol, beer triggers a dopamine release. (ScienceBlog)

Why David Wethley’s Decide: Better Ways of Making Better Decisions is worth a look. (Reading the Markets)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.

*Wording changed in light of recent horrible events.