Quote of the day

Steven Place, “Curation acts as a noise filter.” (Investing With Options)

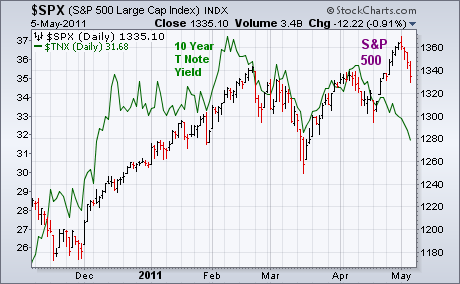

Chart of the day

Bond yields are dropping and defensive sectors are leading. (StockCharts Blog, ibid)

Markets

Equity sentiment at week-end. (Trader’s Narrative)

Earnings aren’t coming in at that that great a rate this season. (Bespoke)

Continued positive developments on the dividend front. (Horan Capital Advisors)

One manager expects to see a further pick up in M&A activity. (market folly)

Silver

With interest rates so low the incentive to buy stuff remains. (Aleph Blog)

Take silver off your trading screen for a few days. (Dynamic Hedge)

Second worst week for silver, ever. (Bespoke)

Individual investors helped fuel, and are now feeling the pain, of the run-up in silver prices. (WSJ)

Strategy

On the long term importance of demographics to investing. (Empirical Finance Blog)

The bottom vs. a bottoming process: a big difference. (chessNwine)

Big tech is once again looking attractive. (Derek Hernquist, NYTimes)

On the value of losing money. (Pension Pulse)

Funds

As ETFs grow bigger and more important expect to see more questions asked about their composition. (IndexUniverse)

On the tax implications of MLP funds. (WSJ)

Trading ETFs? Use limit orders. (IndexUniverse)

Putting price on the cost of lagging the market. (CBS Moneywatch)

Finance

Lessons from the Flash Crash. (Pragmatic Capitalism)

What are the chances the muni bond tax break disappears? (WSJ)

Global

The BRICs are taking it on the chin of late. (Fund My Mutual Fund, research puzzle pix)

On the attraction of emerging market corporate bonds. (WSJ)

What if Greece leaves the Euro? (Pragmatic Capitalism, Money Game)

Economy

Greg Mankiw asks how long will inflation expectations remain anchored? (NYTimes)

What we want and don’t yet have on the employment front. (Calculated Risk)

Has a jobs recovery finally taken hold? (WSJ, Economix, Big Picture, Economist’s View, Calculated Risk, EconLog, Megan McArdle)

Does Bernanke have it right on inflation, and the role of commodity prices? (Real Time Economics, Free exchange)

Chinese wages and the future of US manufacturing. (FT Alphaville)

What is going on with money supply? (EconomPic Data)

Earlier on Abnormal Returns

Check out what people were clicking on this week. (Abnormal Returns)

Our Saturday long form linkfest. (Abnormal Returns)

Mixed media

Social media is making the world of journalism “more open, and allowing for many different sources..” (GigaOM also Felix Salmon)

Abnormal Returns is a founding member of the StockTwits Blog Network.