Quote of the day

Josh Brown, “The stupidity of having such an obviously unbalanced economy is the more important discussion we should be having right now. The corporations are every bit as vulnerable to the disappearance of the middle class as the middle class is itself.” (The Reformed Broker)

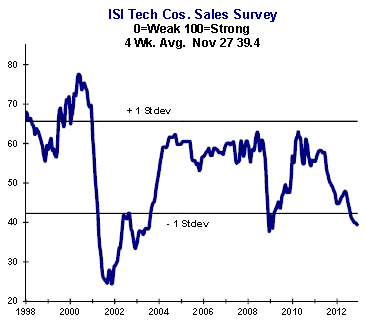

Chart of the day

The technology sector is weaker than commonly believed. (Sober Look)

Markets

A look at Apple ($AAPL) and Google ($GOOG). (UpsideTrader)

Domestic focused stocks have outperfomed in 2012. (Bespoke)

Which view of China’s stock market is right? (Dynamic Hedge)

Where markets stand at week-end. (Global Macro Monitor)

Where one TAA model stands going into December. (MarketSci Blog)

Day of the month seasonality for December. (MarketSci Blog)

Strategy

It’s tough to be bullish on muni bonds at present. (Jason Zweig also Barron’s)

Not every MLP is created equal. (WSJ)

Two VIX ETP success stories. (VIX and More)

Do you want your hedge fund to have 80% of their assets in two stocks? (research puzzle pix)

Companies

John Malone continues to re-jigger his Liberty Media ($LMCA) empire. (Barron’s)

A Microsoft ($MSFT) comeback seems like a distant hope. (SAI)

Caveat emptor

Seriously, don’t buy promoted penny stocks. (Aleph Blog)

If you aren’t looking for your money, who is? (Howard Lindzon)

The fiscal cliff is a media creation. (Barry Ritholtz)

Finance

Acquisition-based growth strategies rarely work. (Musings on Markets)

A new class of investors is buying American houses. (Economist)

The SEC and CFTC should merge. (Economist)

Global

Europe is still at risk of blowing up. (Tyler Cowen)

Norway wants to buy some quality US real estate. (Bloomberg)

Economy

Q4 GDP is not looking good. (Real Time Economics, Pragmatic Capitalism)

On the plus side 2013 should be the end of the financial crisis for the US economy. (Money Game)

What would happen if all the Bush tax cuts lapsed? (Econbrowser)

Does MBS buying do more to goose the economy than buying Treasuries? (Real Time Economics also Avondale Asset)

A look back at the economic releases for the week. (Bonddad Blog, Calculated Risk)

A look at the economic schedule. (Calculated Risk, Money Game)

Earlier on Abnormal Returns

What you missed in our Saturday long(ish) form linkfest. (Abnormal Returns)

Top clicks this week on Abnormal Returns. (Abnormal Returns)

Mixed media

US birthrates continue to plunge. (Slate)

The law of unbundling. (Leigh Drogen)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.